September 17, 2024

Vehicle Age, Telematics and Technology Top Issues

by Michael Chung

These Issues Now Impacting Business to a Greater Degree than General Economic Concerns

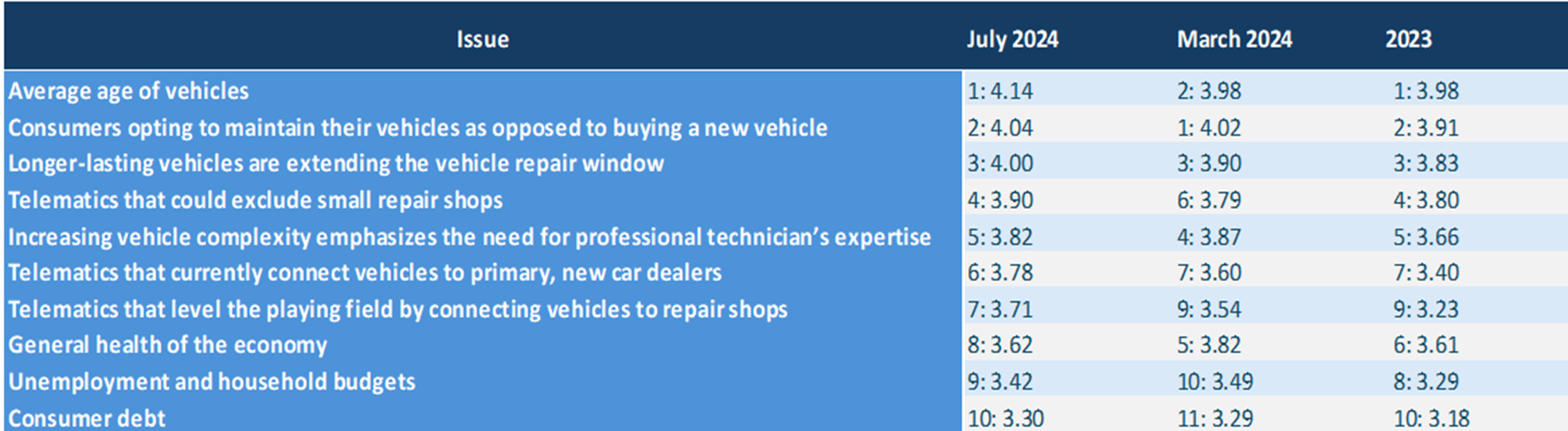

Auto Care Association conducts a quarterly survey of members on the impacts of economic, consumer, technology and repair outlet trends on their businesses. The average age of vehicles and consumers’ decision to maintain their vehicle rather than purchase a new one, continue as the top two issues from 2023 into 2024.In this year’s first two survey iterations (March and July), “telematics that could exclude small repair shops” and “increasing vehicle complexity emphasiz[ing] the need for professional technicians’ expertise” continue to rank highly. Economic issues like the “general health of the economy” and “unemployment and household budgets” declined compared to recent surveys.

Top Issues Impacting Member Businesses

Q: Using the scale from 1 (Low Impact) to 5 (High Impact), please rate the following statements in terms of how much impact each of the following issues is currently having on your business …

Randy Wright, executive partner at Synergy Global Business Solutions noted that older vehicles are an indicator for “strength in our industry” which is “stimulated by increased replacement parts business and DIFM labor business.” Wright pointed out that the return-to-office and suppressed new vehicle sales also contributed to this change.

Vehicle Miles Traveled [VMT] data, provided by Arity and found in Auto Care’s TrendLensTM platform, indicates that VMT in June 2024 was at its second-highest level since January 2019 which may in-part confirm the return to office thesis. Additionally, the 2025 Factbook reports the average age of light vehicles has consistently increased over the last ten years from 11.4 years in 2014 to 12.6 years old in January 2024.

Survey respondents reported a growing impact from telematics issues. Ivan Gomez, vice president of Retail and Schnair Sales & Service, highlighted that some shops are turning down customers after “spending a few hours trying to diagnose” a vehicle. Gomez noted that impacted categories used to center around engine management but have now grown to steering, braking, and other systems.

The 2025 Auto Care Factbook confirms the growing impact of telematics issues is a multi-year trend with concerns with the exclusion of small repair shops and the opportunity to level the playing field with the technology rank higher in impact by multiple positions since 2022.

In contrast to telematics’ rise as an increasingly impactful issue, the perceived impact of general economic health, unemployment and household budgets have declined. This as the unemployment rate increased from 3.7% in December 2023 to 4.3% in July 2024 and disposable income has grown at almost one third the rate it grew at in 2023. While these indicators of economic health indicate softening economic conditions, current conditions may still be better than previously expected. Inflation, for example, appears to have stabilized around 3%.

We appreciate our members’ participation in these surveys to help us understand the most pressing issues in the industry. If you are interested in participating in this study, contact me via email. Learn more about Right to Repair here.

Michael Chung, Director, Market Intelligence

Ready to dive into market research? I provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. More About Me

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Latest related

Content

-

[WATCH] Driver Behavior Trends and Their Impact on Parts and Service Opportunities

March 17, 2022This webinar analyzes driving behavior at the national, state, and local levels. Gain insights into: consumer behavior; driving patterns; and potential impacts on parts replacement, service and repair scheduling, vehicle age, and the car parc.

-

[WATCH] 2022 Business Outlook: Top Emerging Opportunities and Challenges

February 4, 2022This webinar explores need-to-know emerging opportunities and challenges for the coming year: current status of supply chain issues and what to expect in the year ahead and more.

-

[WATCH] How to Use Vehicle Miles Traveled to Better Your Bottom Line in 2022

December 3, 2021Vehicle Miles Traveled has been respected for years as a key indicator of aftermarket opportunities. Historically, planning has been limited to directional indicators but now aftermarket businesses can leverage more detailed insights on geographic differences as well as vehicle differences to more effectively take advantage of aftermarket opportunities.

Visit