Cost Savings Drives DIY Behavior while Expertise and Experience Influence DIFM

Auto Care validated through recent research that do-it-yourself (DIY) maintenance is driven principally by cost savings. DIYers identify “lack of knowledge” and “complexity of repairs” as the top challenges when maintaining vehicles on their own.

Do-it-for-me (DIFM) customers value professional service providers’ expertise and experience, trust them, and personally lack the skill to maintain their vehicles. Cost concerns are the primary challenge for these consumers, though.

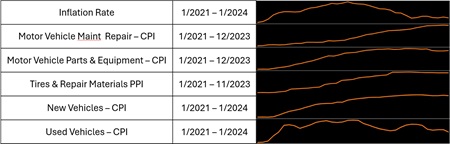

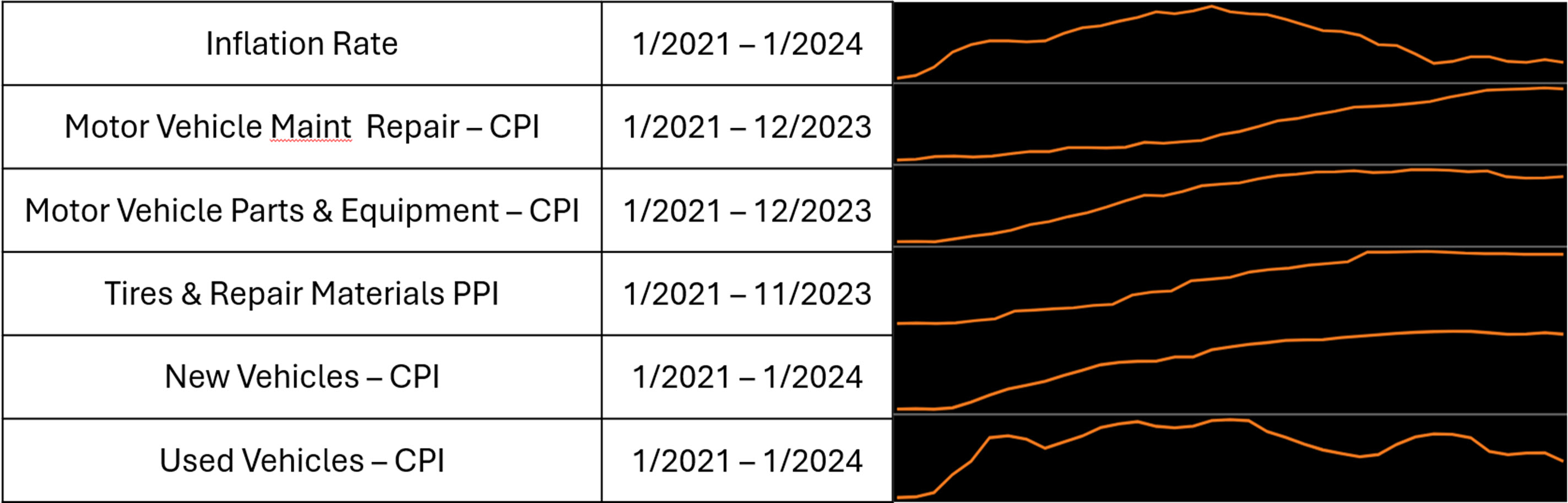

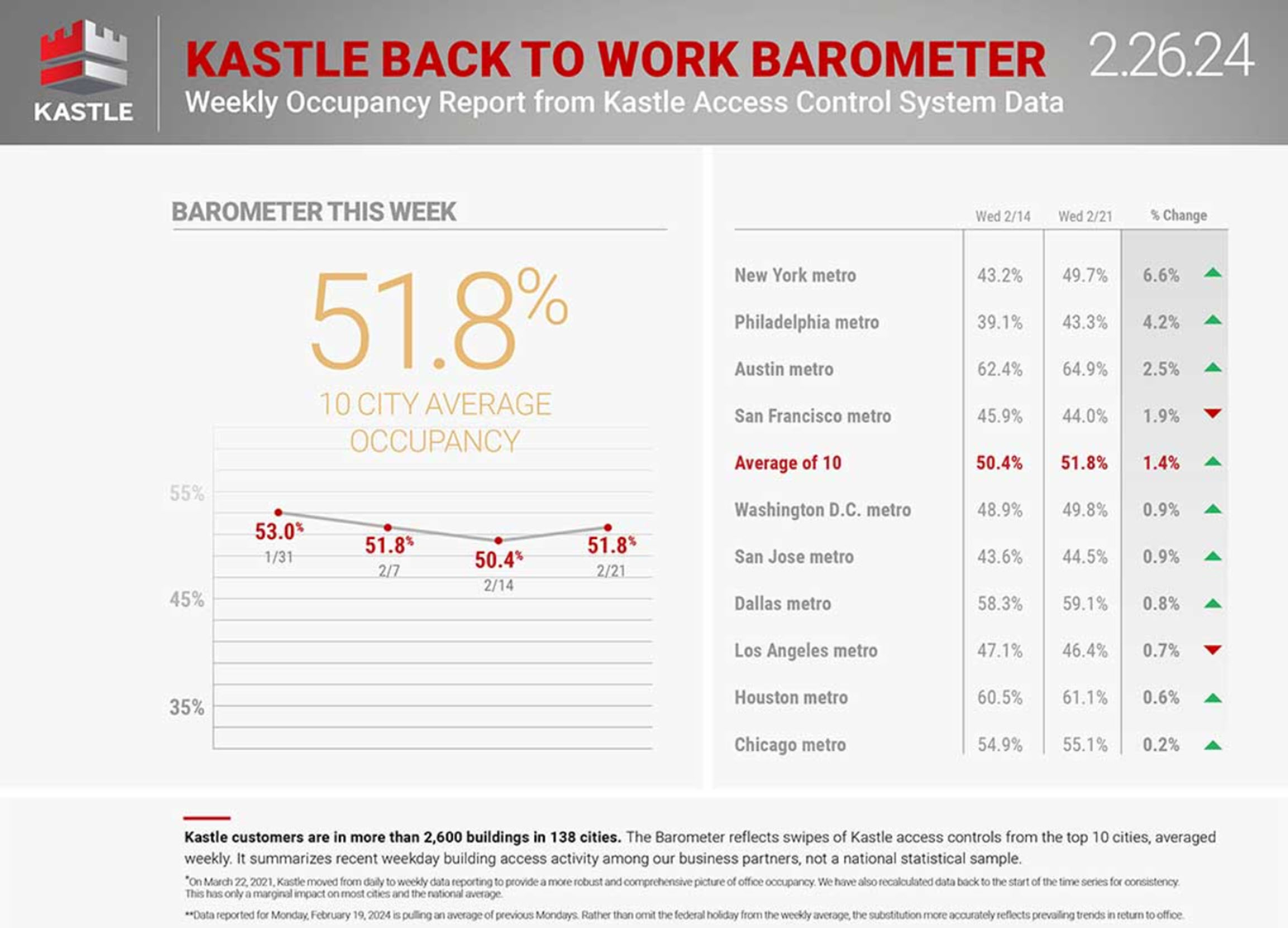

Ever since the pandemic affected consumer behavior (activities, driving, purchase, vehicle maintenance), our Market Intelligence Committee thought it would be helpful to reassess how vehicle owners approach the DIY vs. DIFM decision process for vehicle maintenance. With high inflation throughout 2023, and increasing cost of vehicle maintenance (Figure 1) and perhaps continued time for DIY activity (Figure 2) and accessibility to parts via e-commerce channels, we were interested to see whether cost savings was a primary reason for DIY activity, along with:

- What event/incident prompted consumers to begin the decision path?

- What information did consumers seek out while determining which path to take?

- What sources/channels of information were utilized?

- When evaluating DIY vs DIFM, what are the perceived benefits and drawbacks for each?

We engaged Hanover Research to survey U.S. adults who own a vehicle for personal use, are involved in the maintenance decision process, recently conducted maintenance or service on their vehicle, and who do not work in the automotive repair industry. The survey was administered online, and respondents were recruited through an online panel. The analysis includes a total of 1,081 respondents following data cleaning and quality control.

Maintenance Reasons and Focus

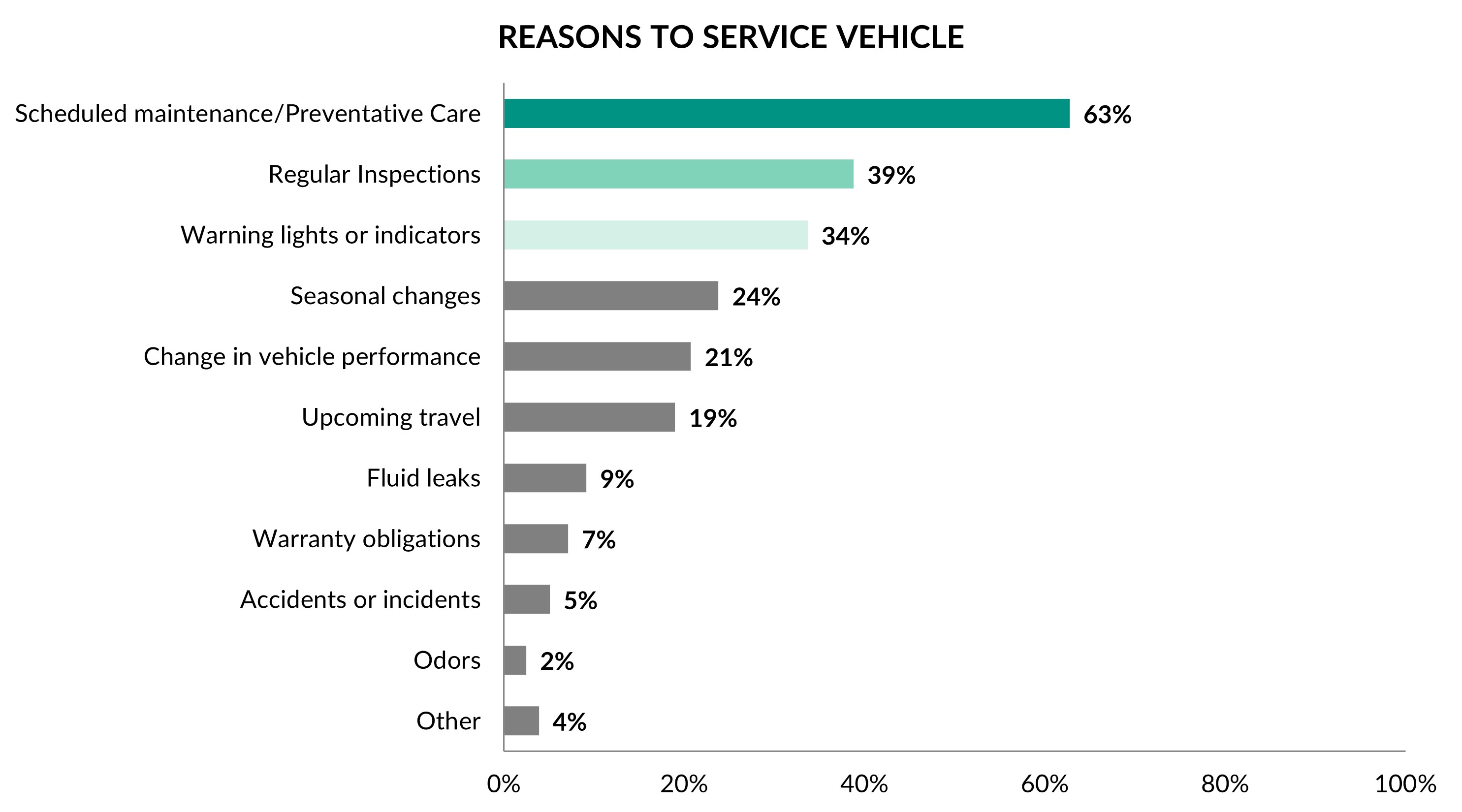

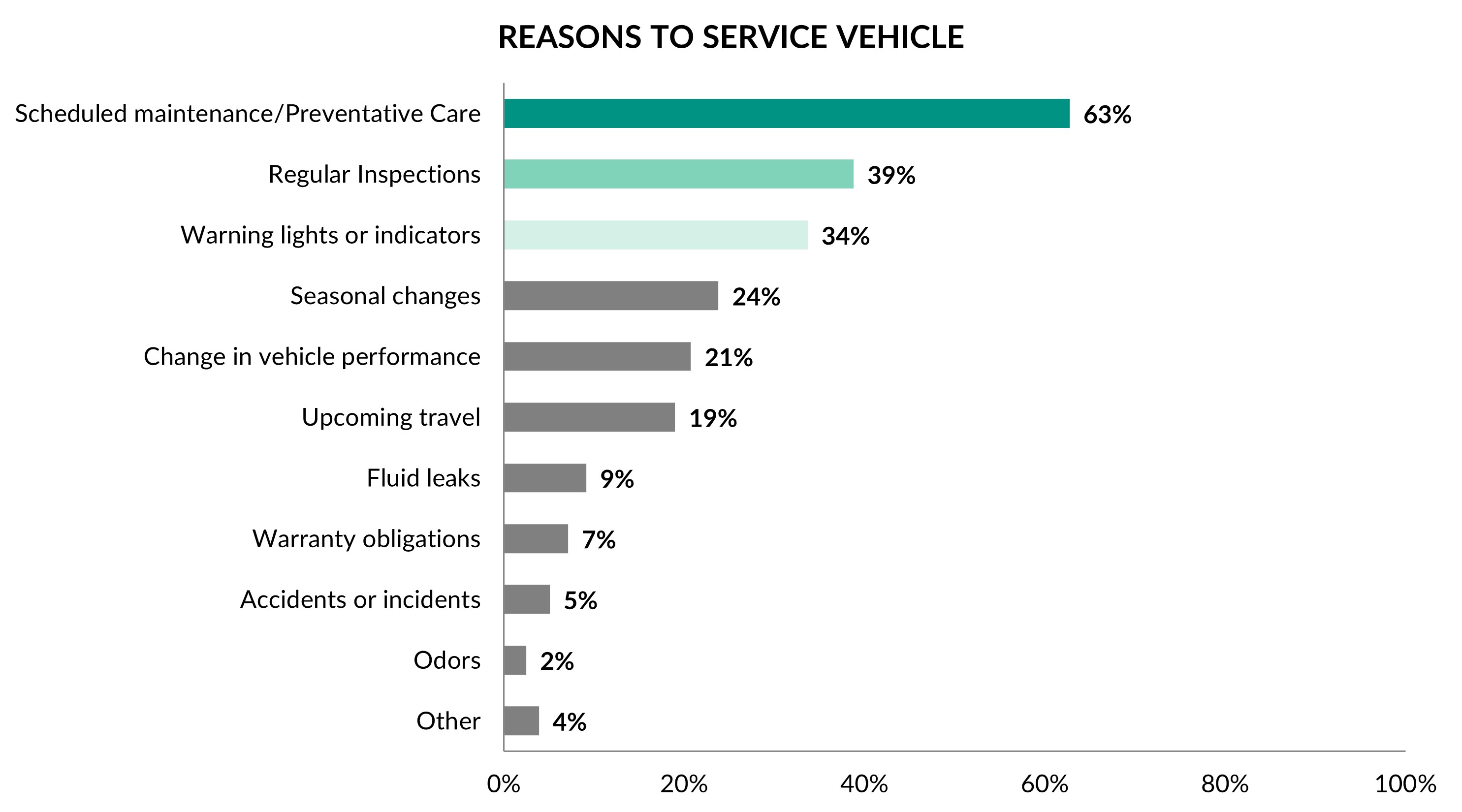

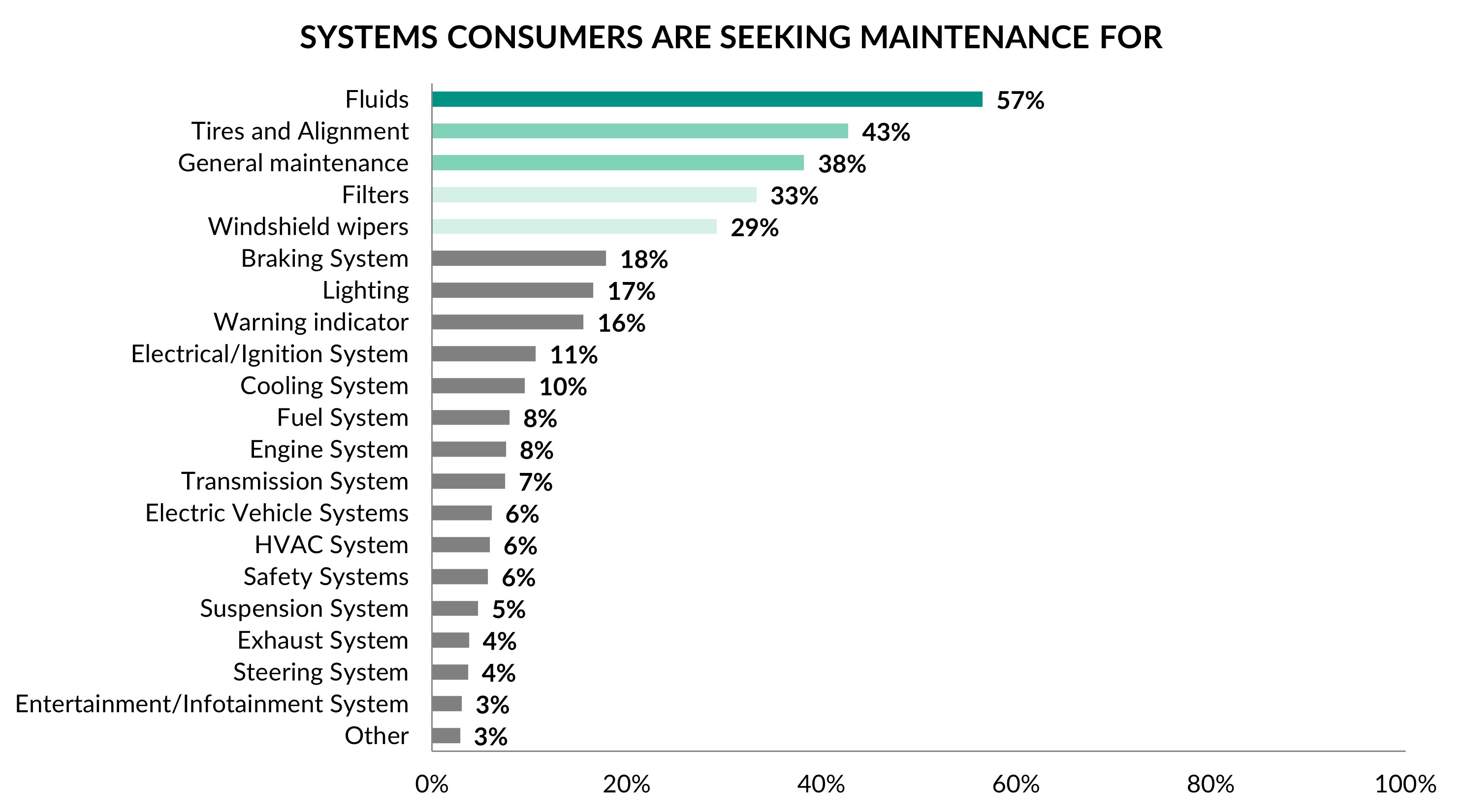

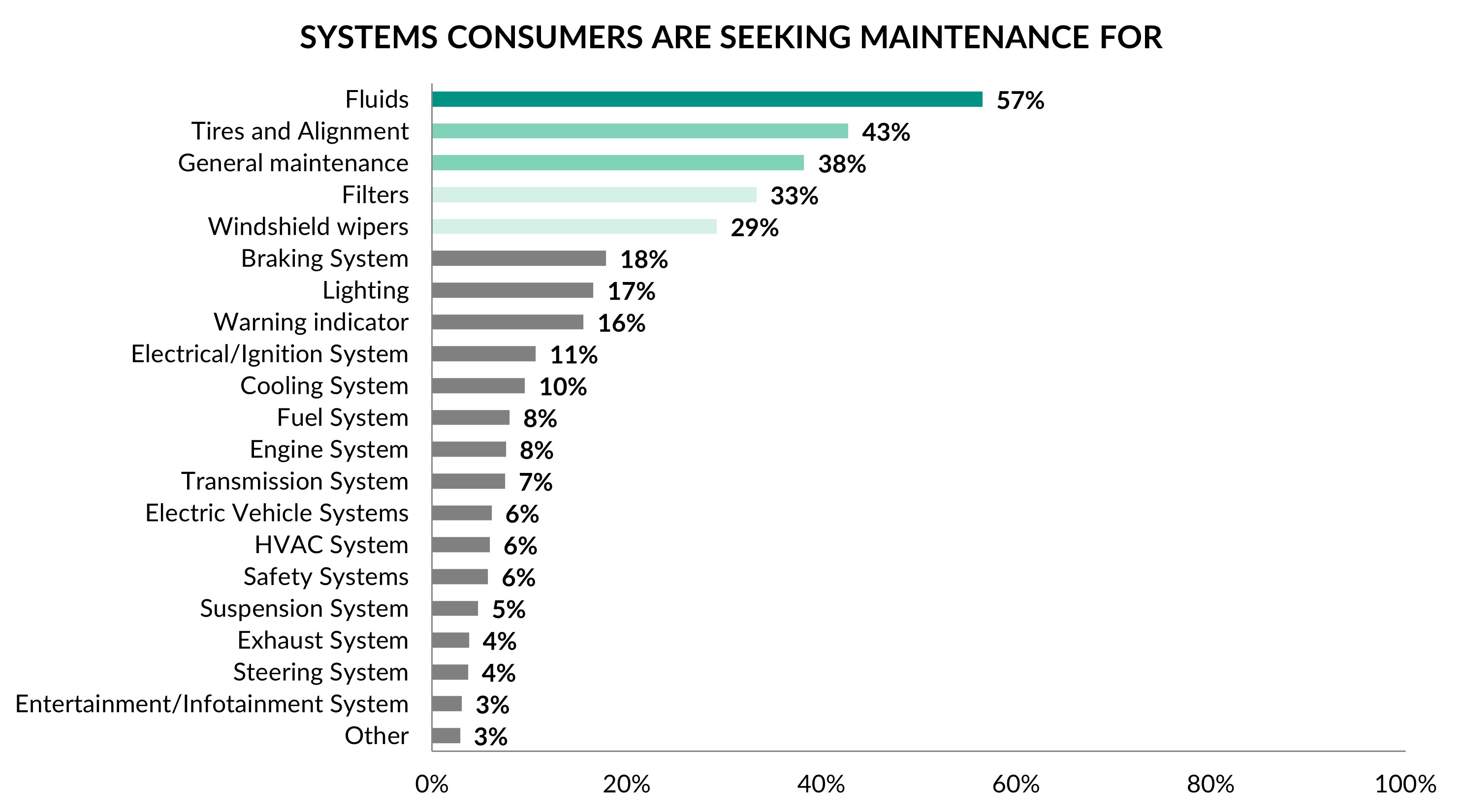

Scheduled maintenance and preventative care drive vehicle maintenance, typically for fluids and tire-related work (Figure 3). As pictured (Figure 4), scheduled maintenance is by far the most frequent reason for service, followed by regular inspections and warning lights or indicators. That the majority of service is pro-active maintenance vs. reactive is encouraging. Also, it appears that driving patterns have settled into a bit more of a regular routine with respect to commuting and vacation travel (more on this later), which complements regularly scheduled maintenance.

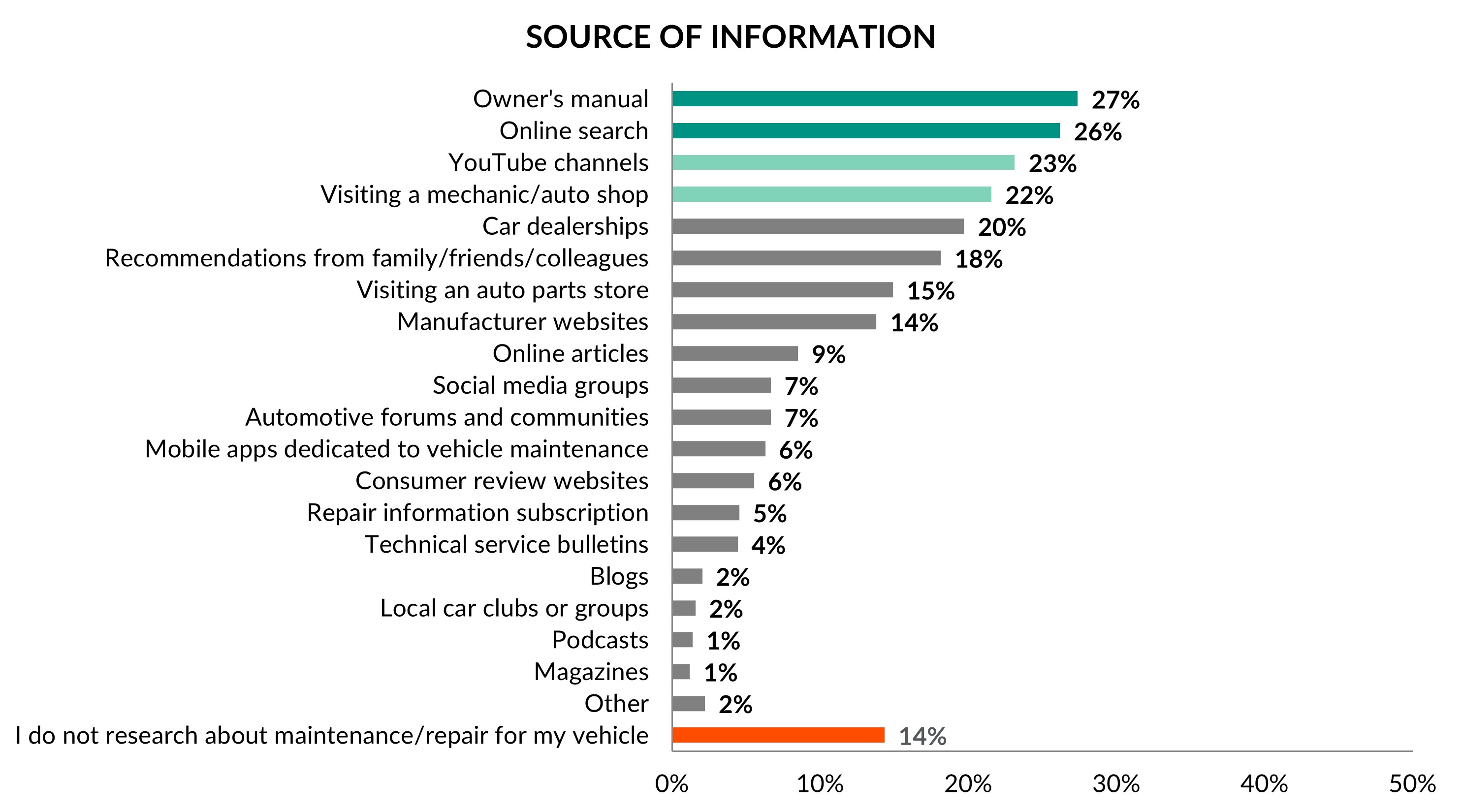

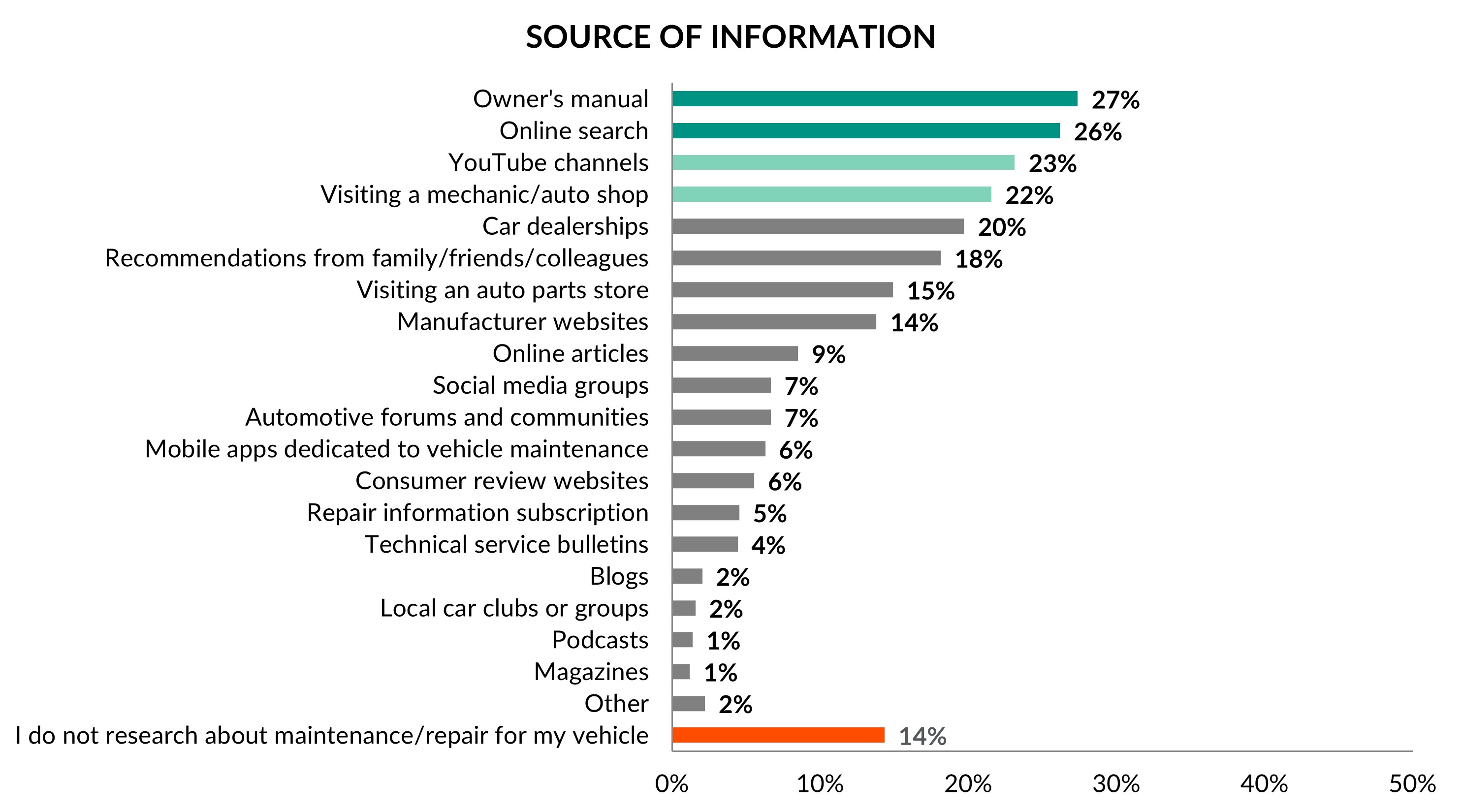

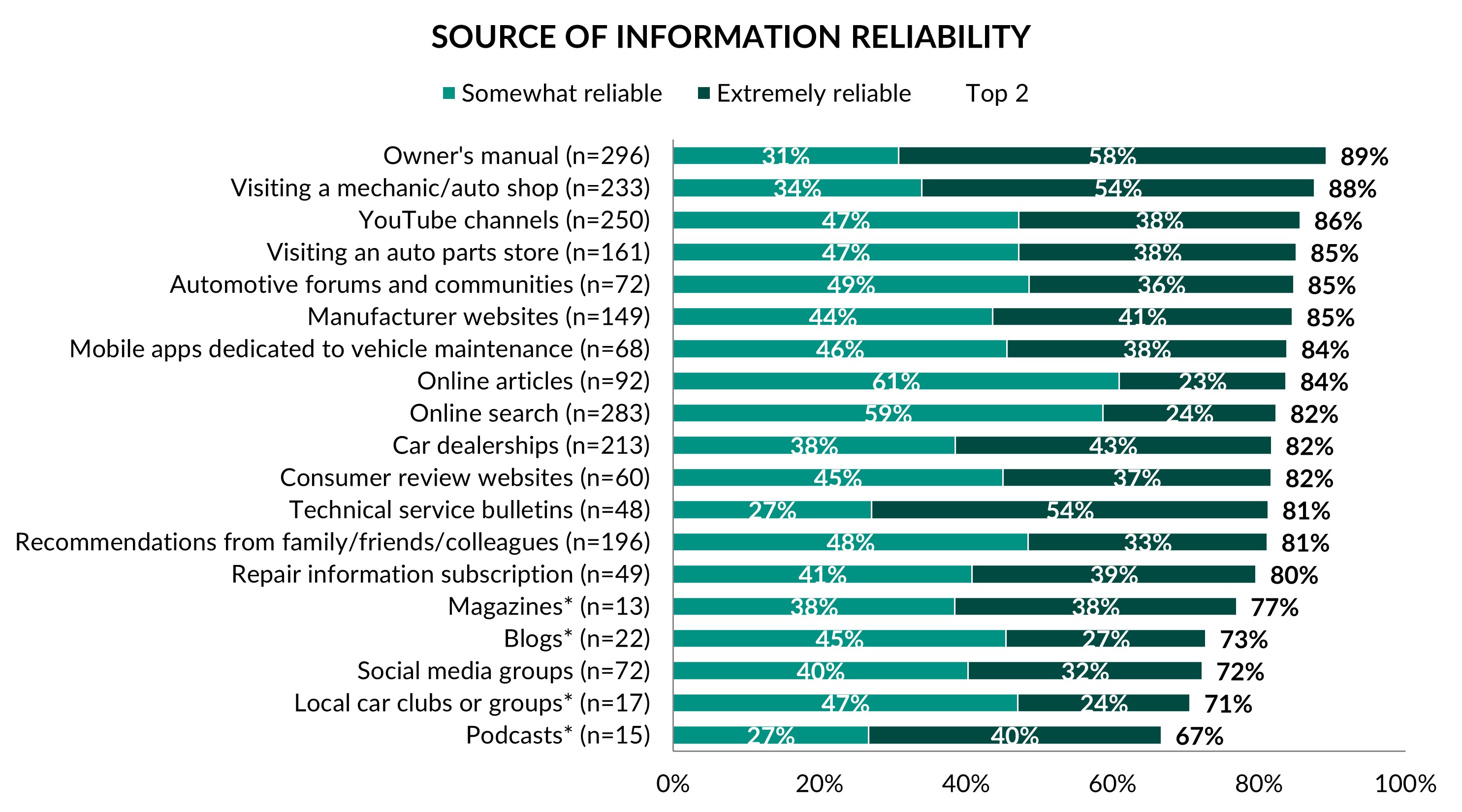

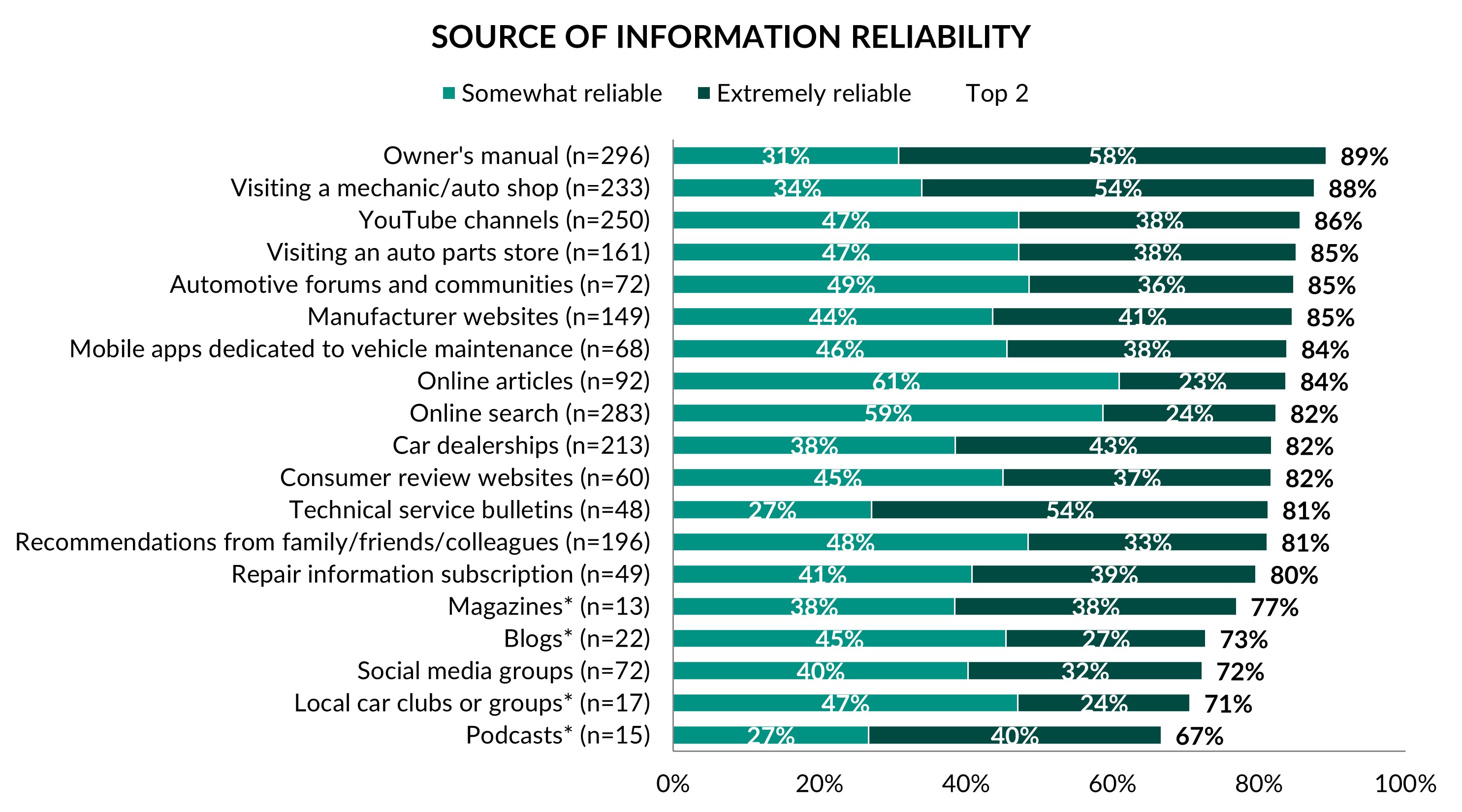

Regarding sources, owner’s manual, online search, and YouTube are the most frequently used (Figure 5), with the owner’s manual viewed as the most reliable (Figure 6). Access to short-form videos on TikTok has exploded as a genre in the past few years, with more than a billion views across the “Auto Repair Shops” (470 million), “Car Repair Shop” (105 million) and “Car Repairs” (569 million) channels. Relatedly, resources for various YouTube repair channels are easy to find, like this one and that one.

Drivers and Challenges

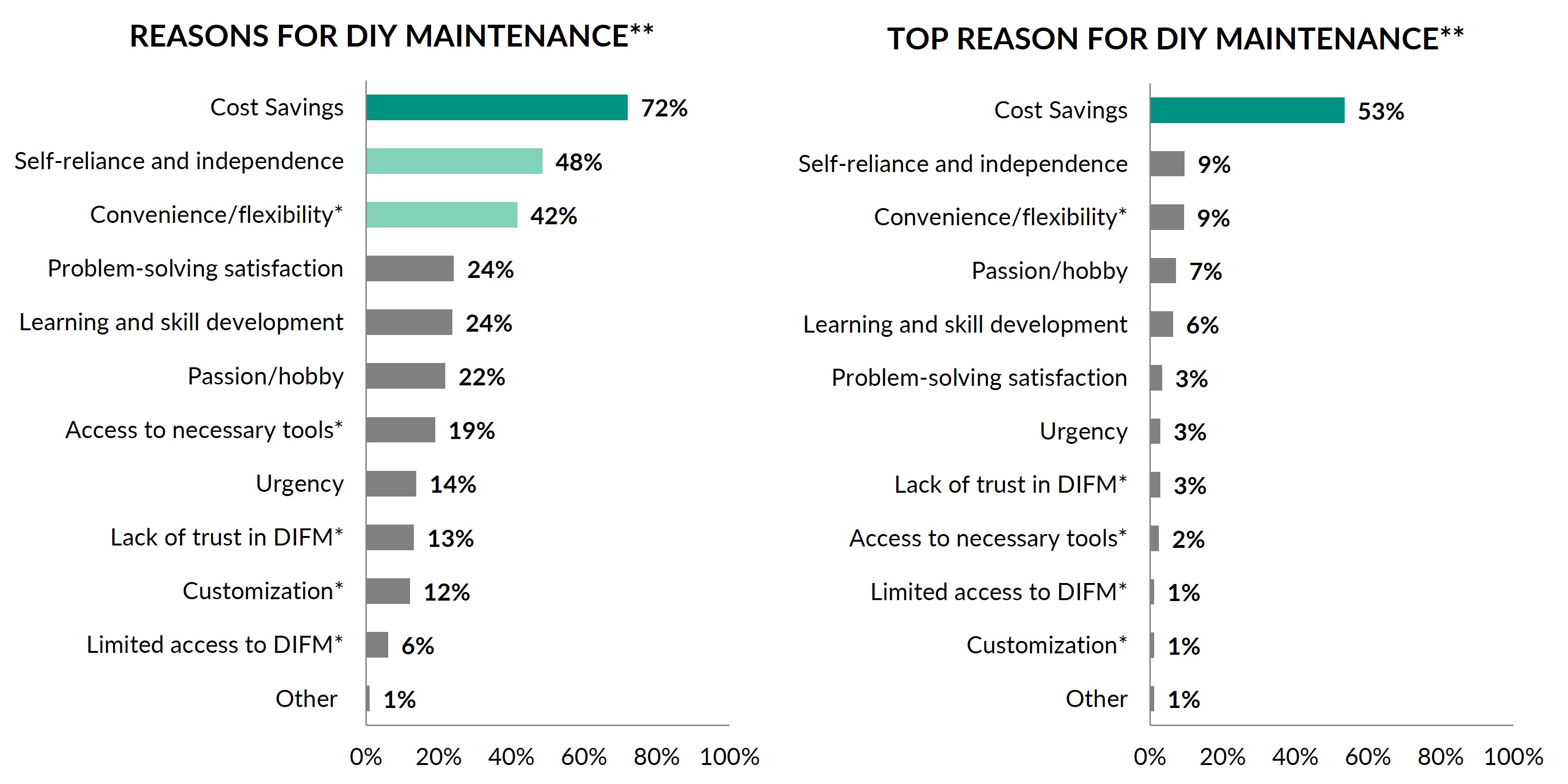

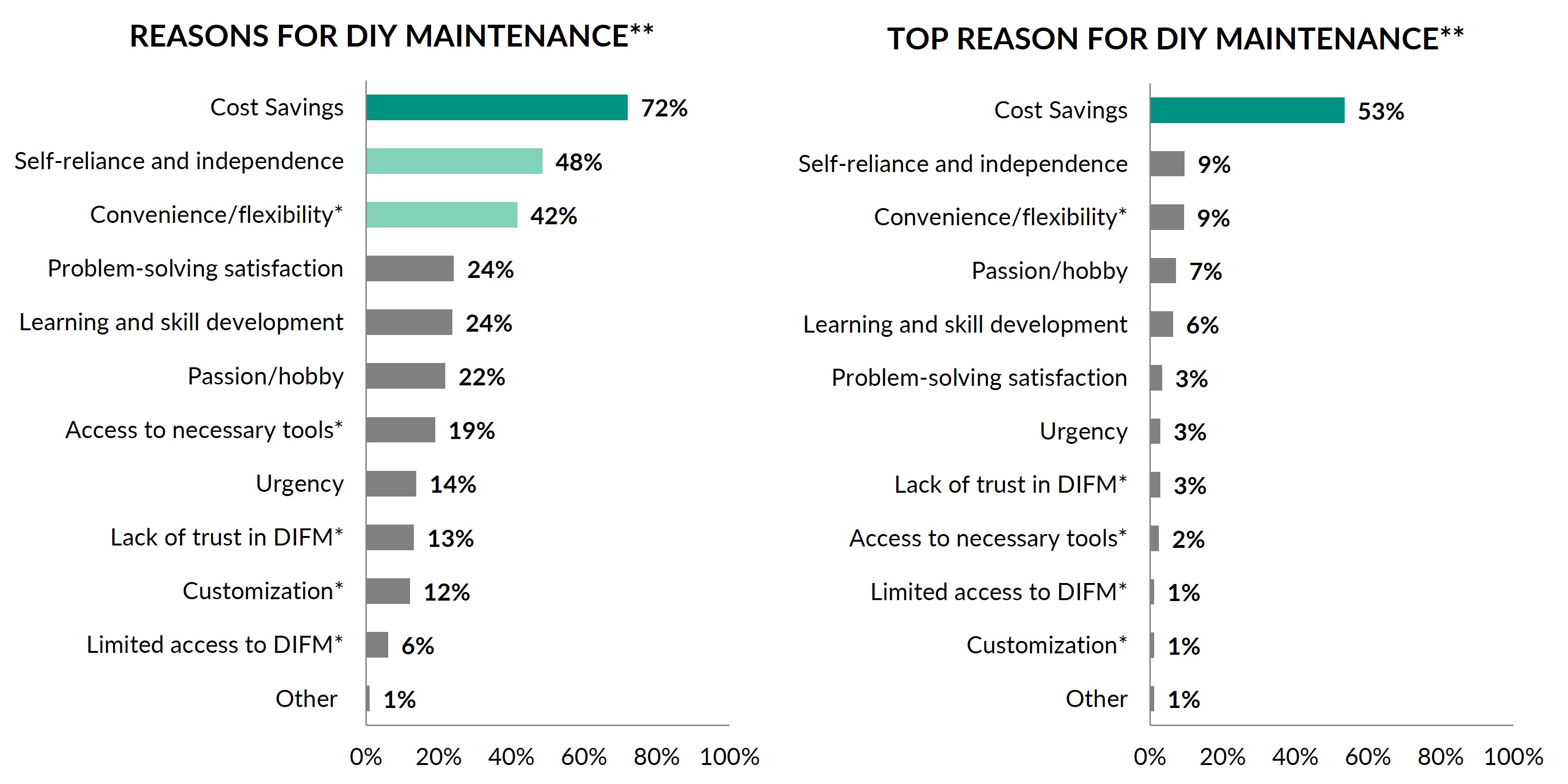

In the current economic climate of rising costs, the higher cost of auto parts and service and general inflation are certainly in the forefront of the minds of those who take their vehicles in for service. As illustrated in Figure 7, cost-savings is the primary and most-important reason for DIY activity.

Not surprisingly, attributes related to fulfillment index highly – self-reliance and independence, problem-solving satisfaction, learning and skill development, and passion/hobby resonate with a sizable portion of those who identify as DIYers.

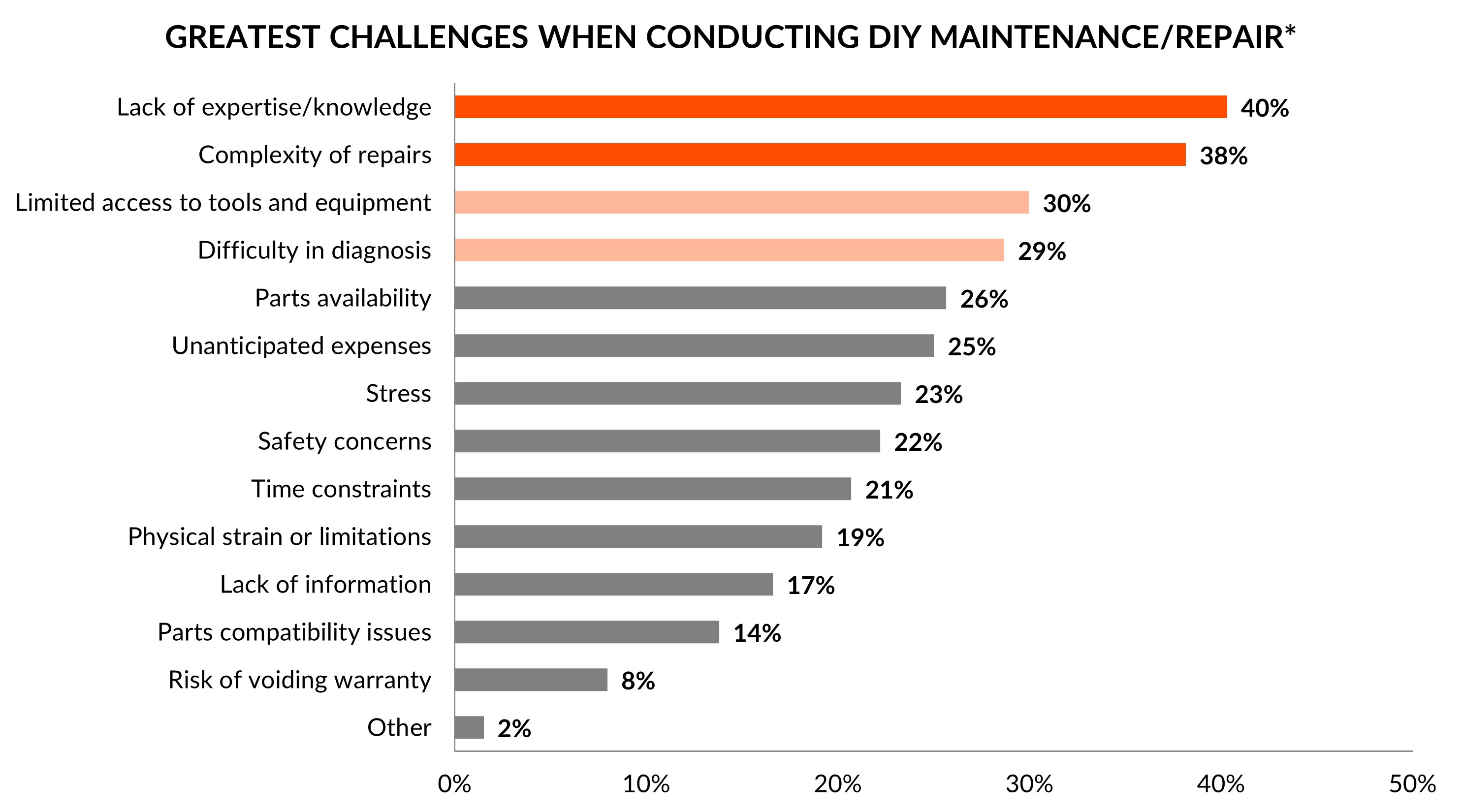

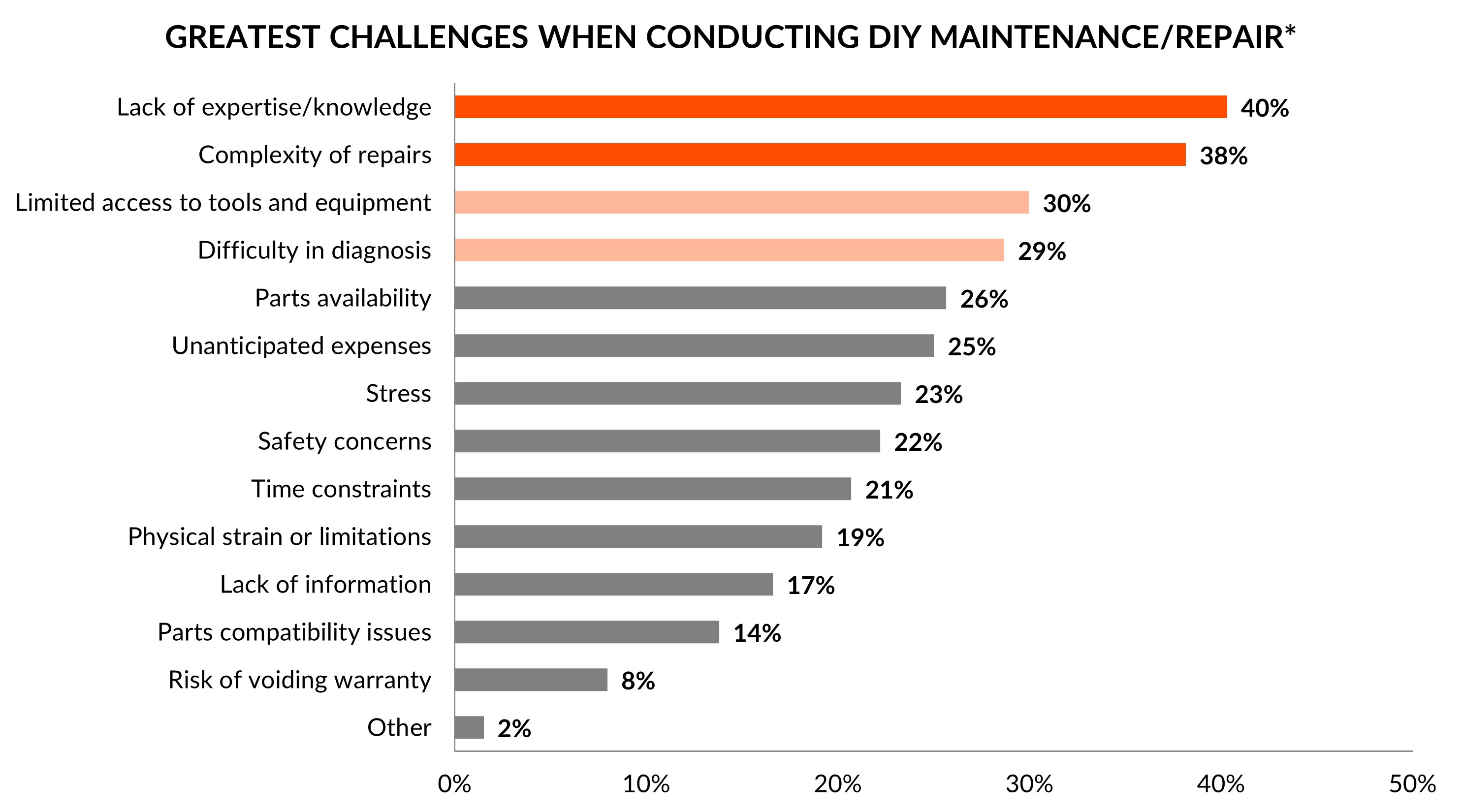

That said, when vehicle owners engage in DIY activity, lack of expertise and complexity of vehicle repairs are the most frequently cited challenges (Figure 8).

These factors, along with limited access to tools and equipment, difficulty to diagnose and lack of information point to the “stretch” that can be associated with DIY activities and the corresponding satisfaction that can be derived from identifying solutions and implementing them, whether on a vehicle or in other aspects of life. As vehicles become even more technologically advanced, the ability to assess and access necessary information arguably becomes more challenging – more on this later in the article.

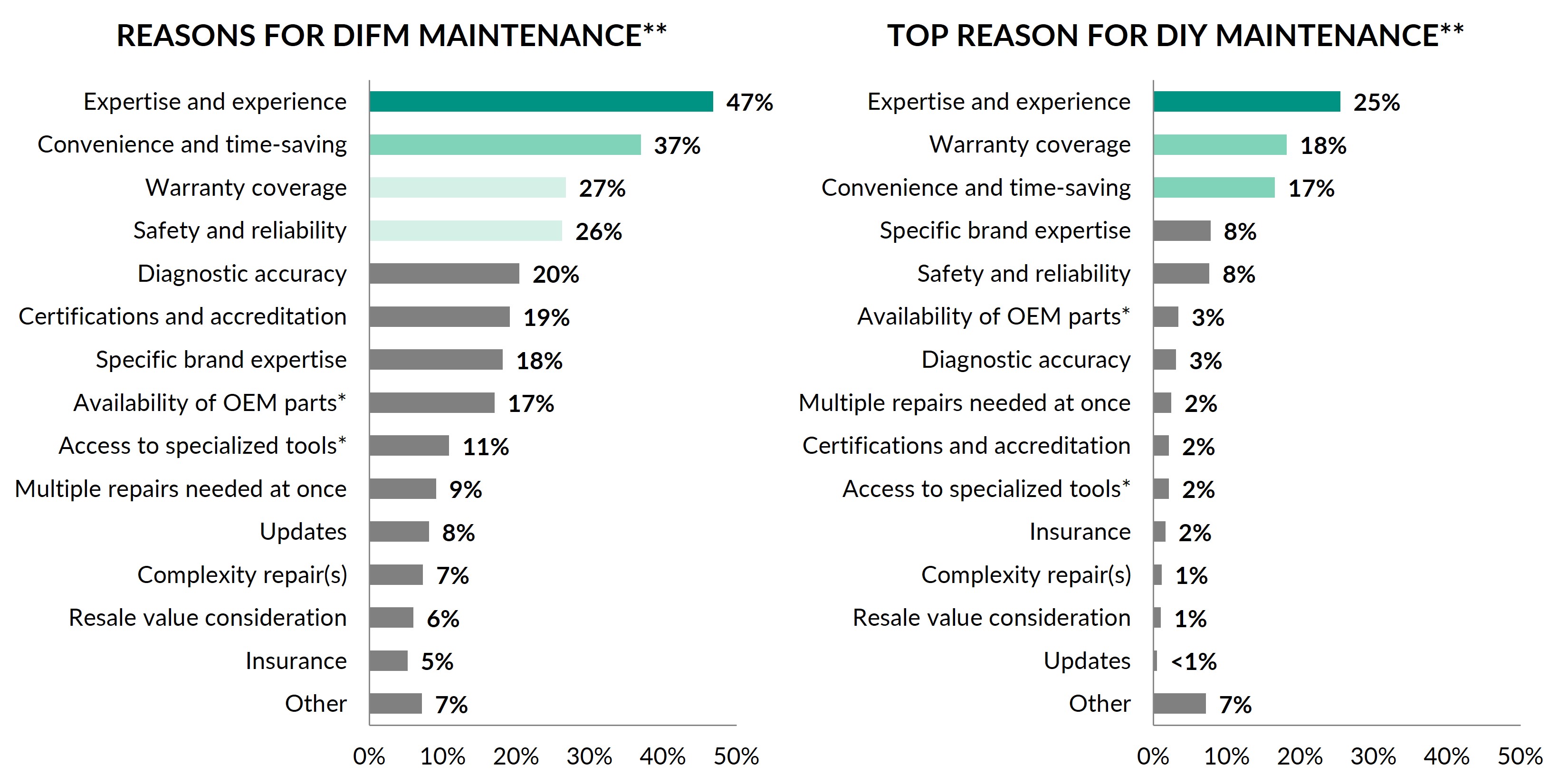

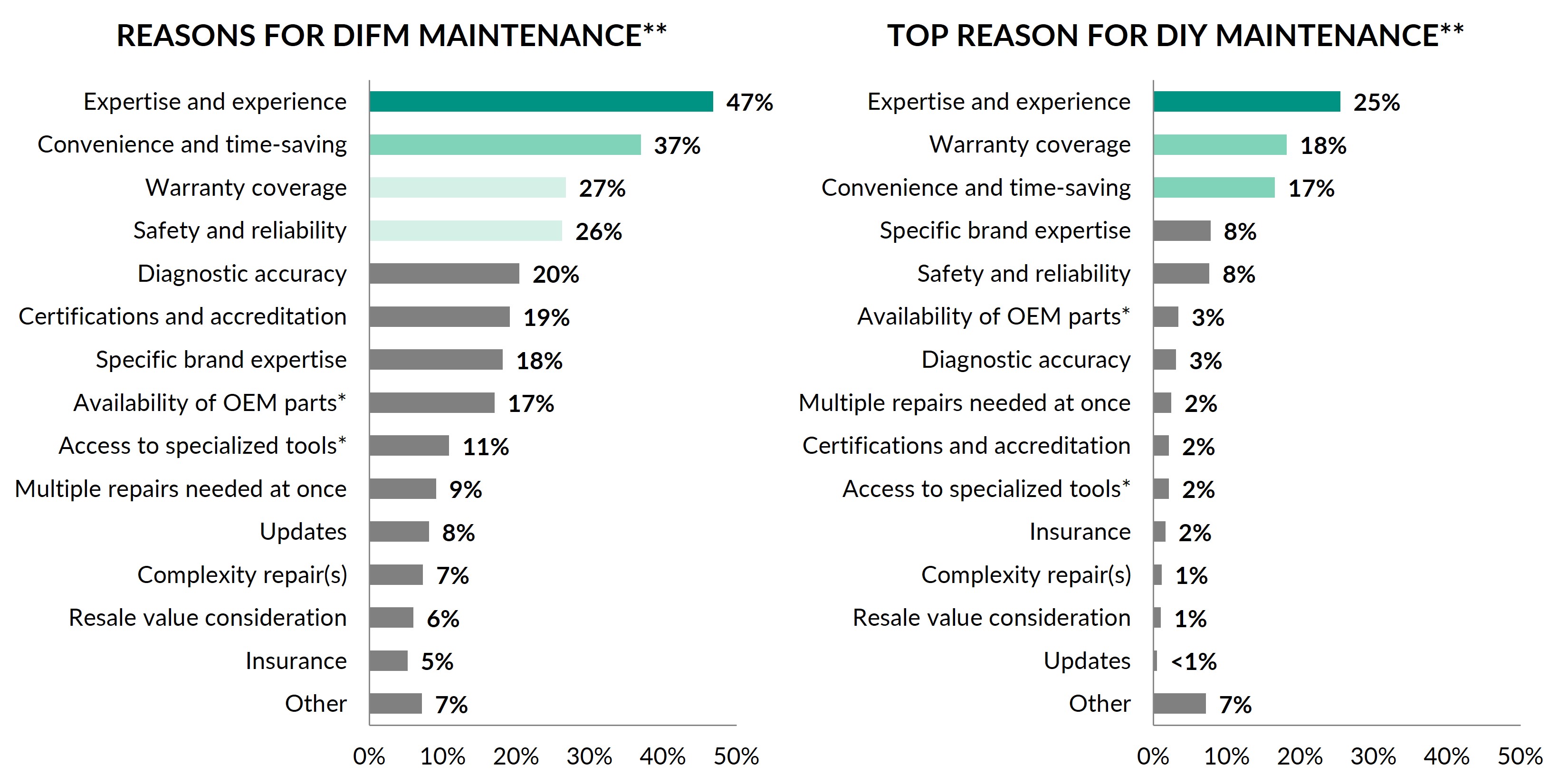

Vehicle owners who engage a dealership or mechanic for vehicle maintenance do so for the provider’s expertise / experience, convenience and timesaving, and warranty coverage (Figure 9).

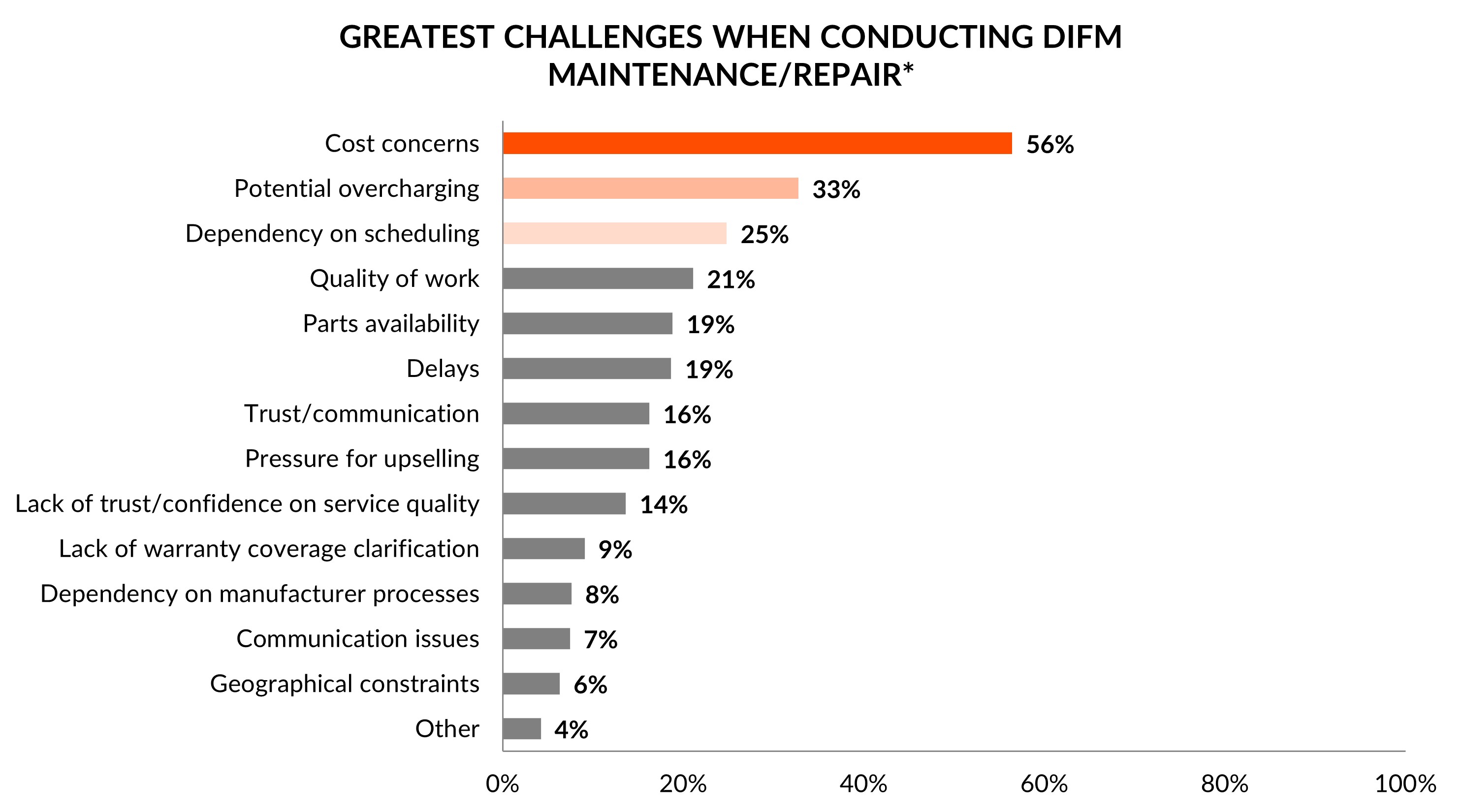

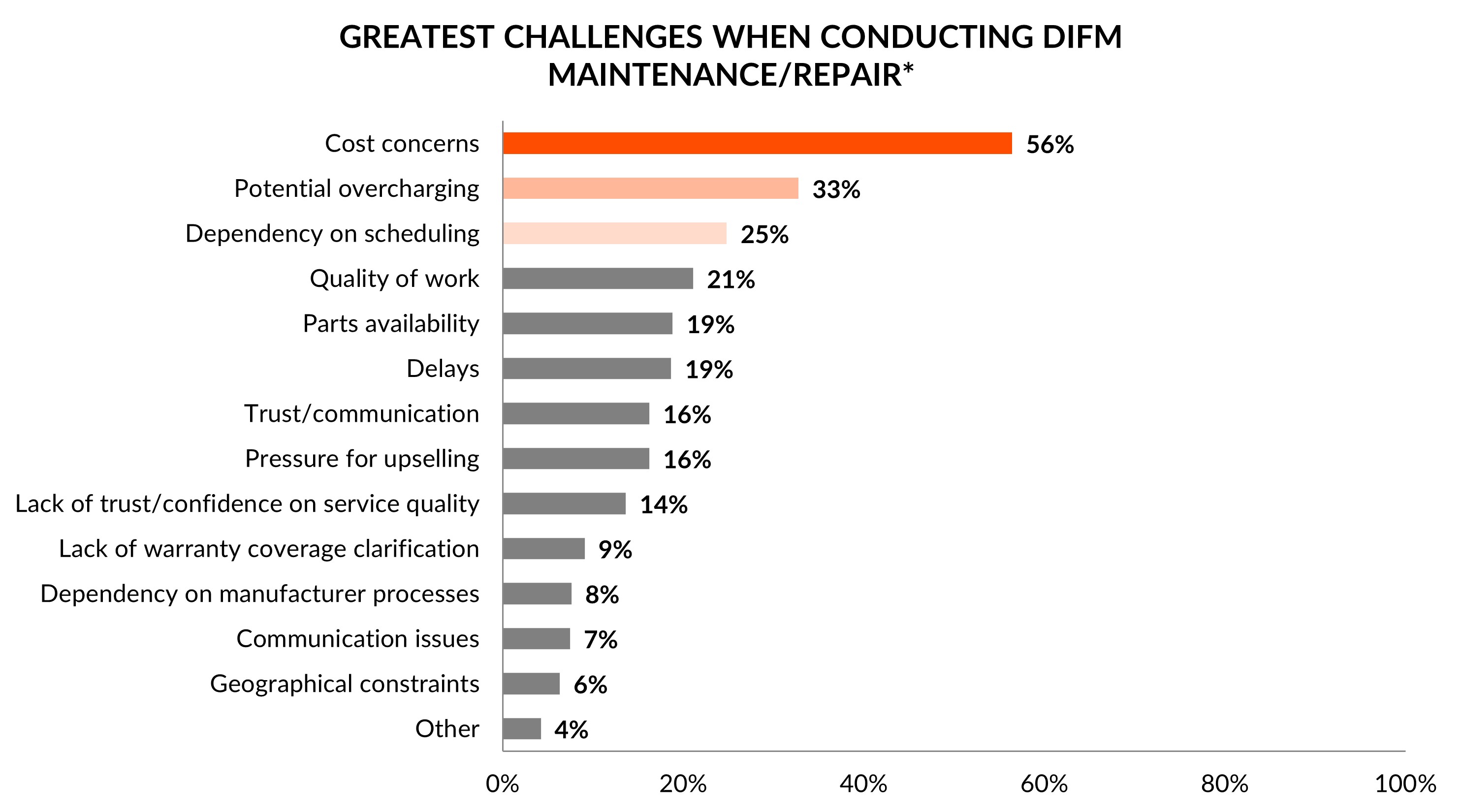

These considerations are intuitive – engage a trusted provider to do something that is beyond your skill set / not your core competency, allows you to use your time more effectively time on other activities, and may be covered under an existing warranty or contract. All of this presumes that your service provider can actually do the work – more on this later. Similarly, DIFM customers also face cost-related challenges: cost concerns and potential overcharging are the greatest challenges when conducting DIFM vehicle maintenance/repair (Figure 10).

near-term outlook is promising, but threats loom

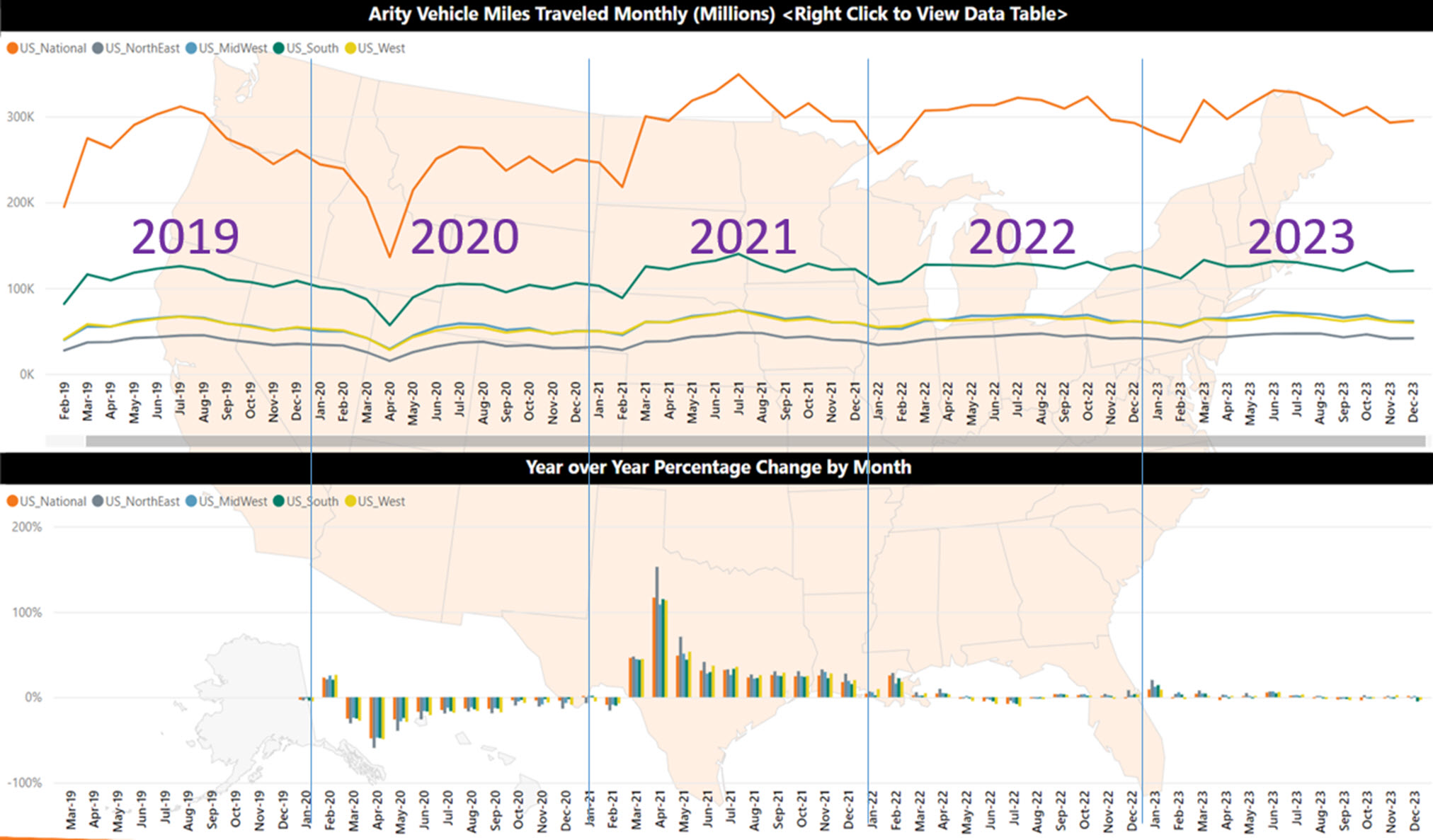

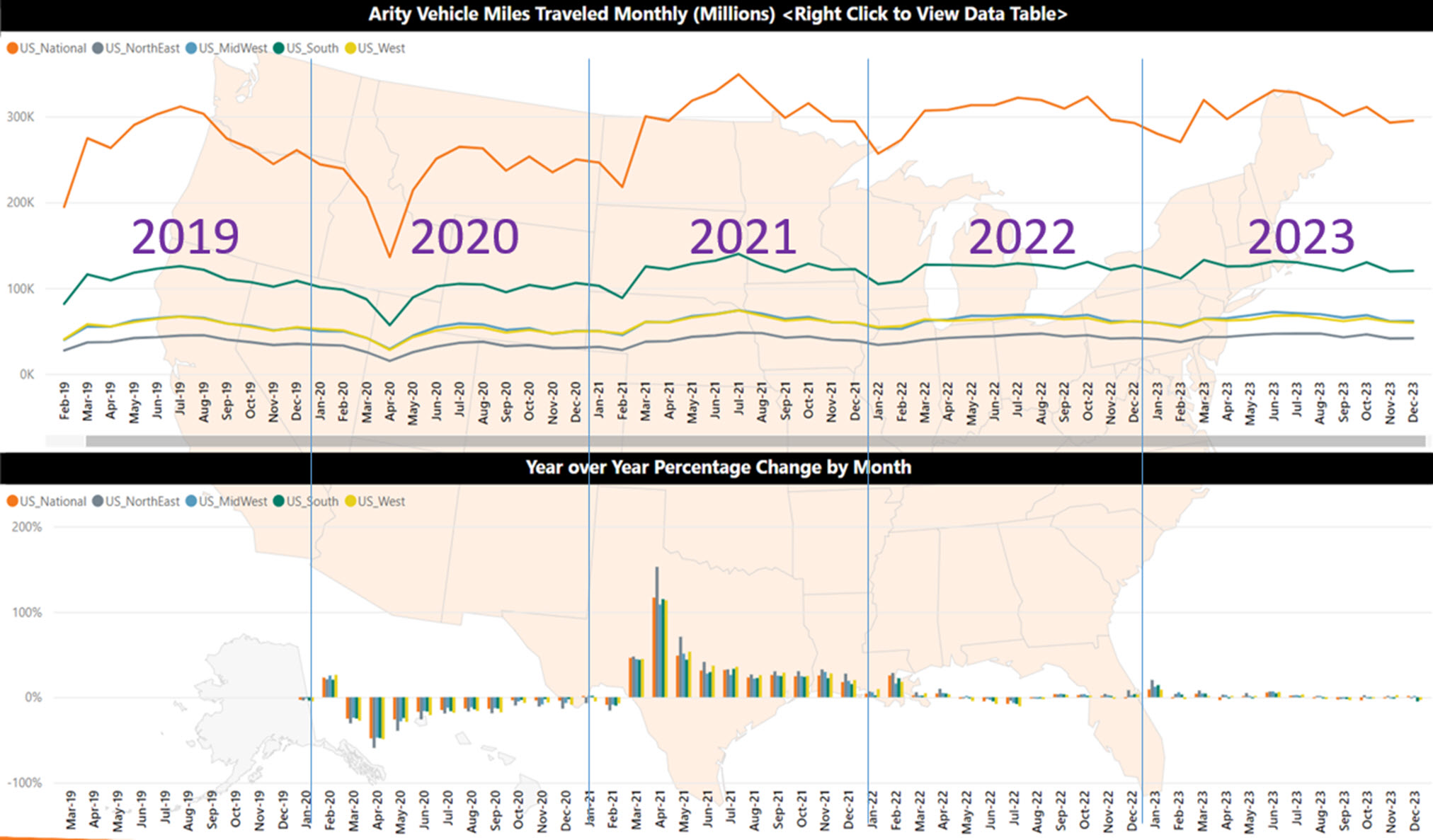

Vehicle Miles Traveled (VMT) continues to be a leading indicator of aftermarket activity, particularly as the car parc ages. Based on telematics data from Arity, VMT in 2023 was 3.66 trillion miles, 0.65% higher than in 2022 (Figure 11). Arity VMT data is available to Auto Care members in TrendLensTM. As mentioned in various publications (including the Factbook and this article), one advantage of Arity VMT data is its speed – we publish it a week after the end of each month. This allows you to more easily keep the pulse on driver activity and forecast its impact on your company’s performance. We’ve recently discussed with a few members some of the nuances of Arity VMT data and U.S. DOT VMT data – how comparable are they? Is one more “accurate” than the other? Can you mix and match data across the two sets? I’ll explore these and related topics in a future blog post.

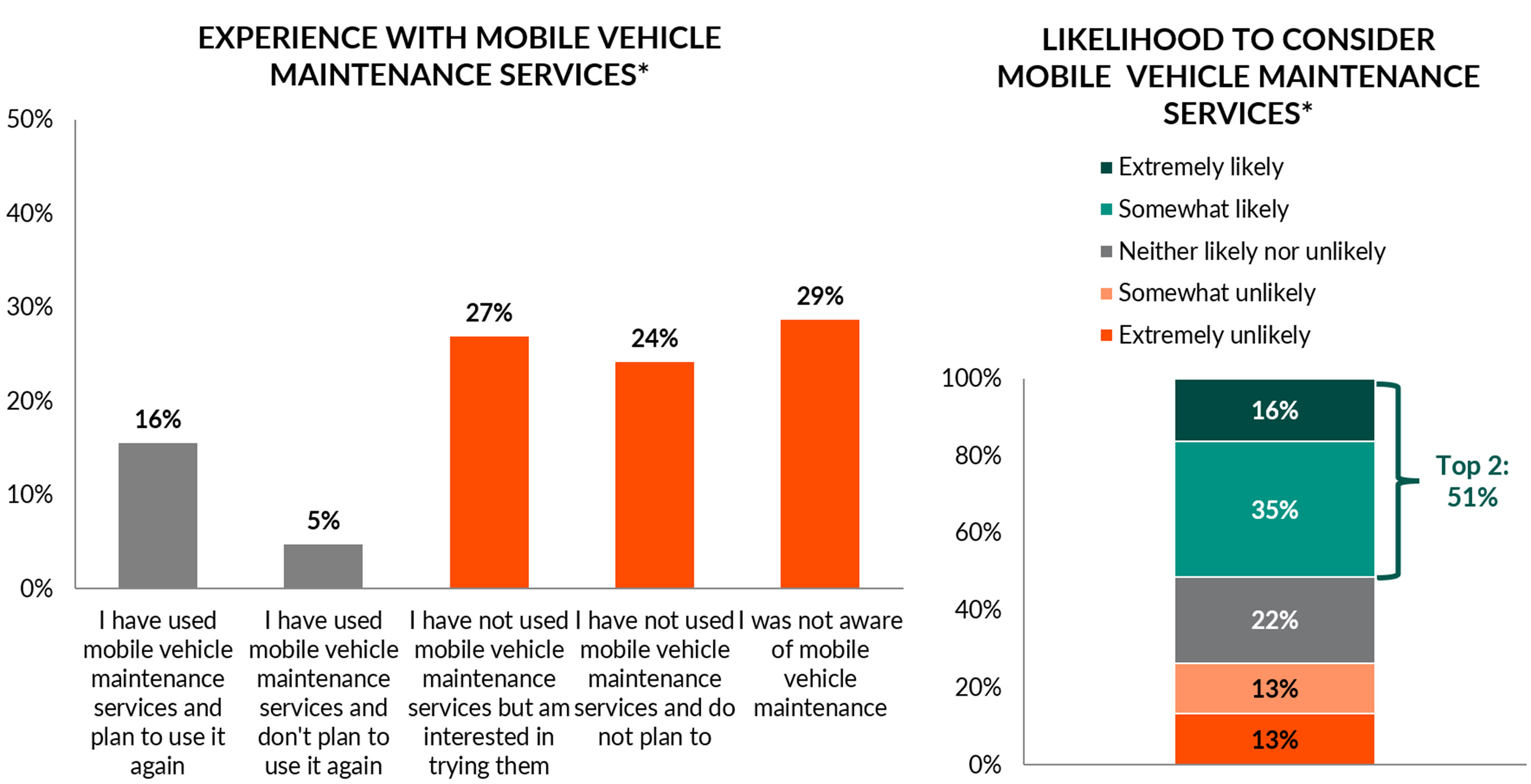

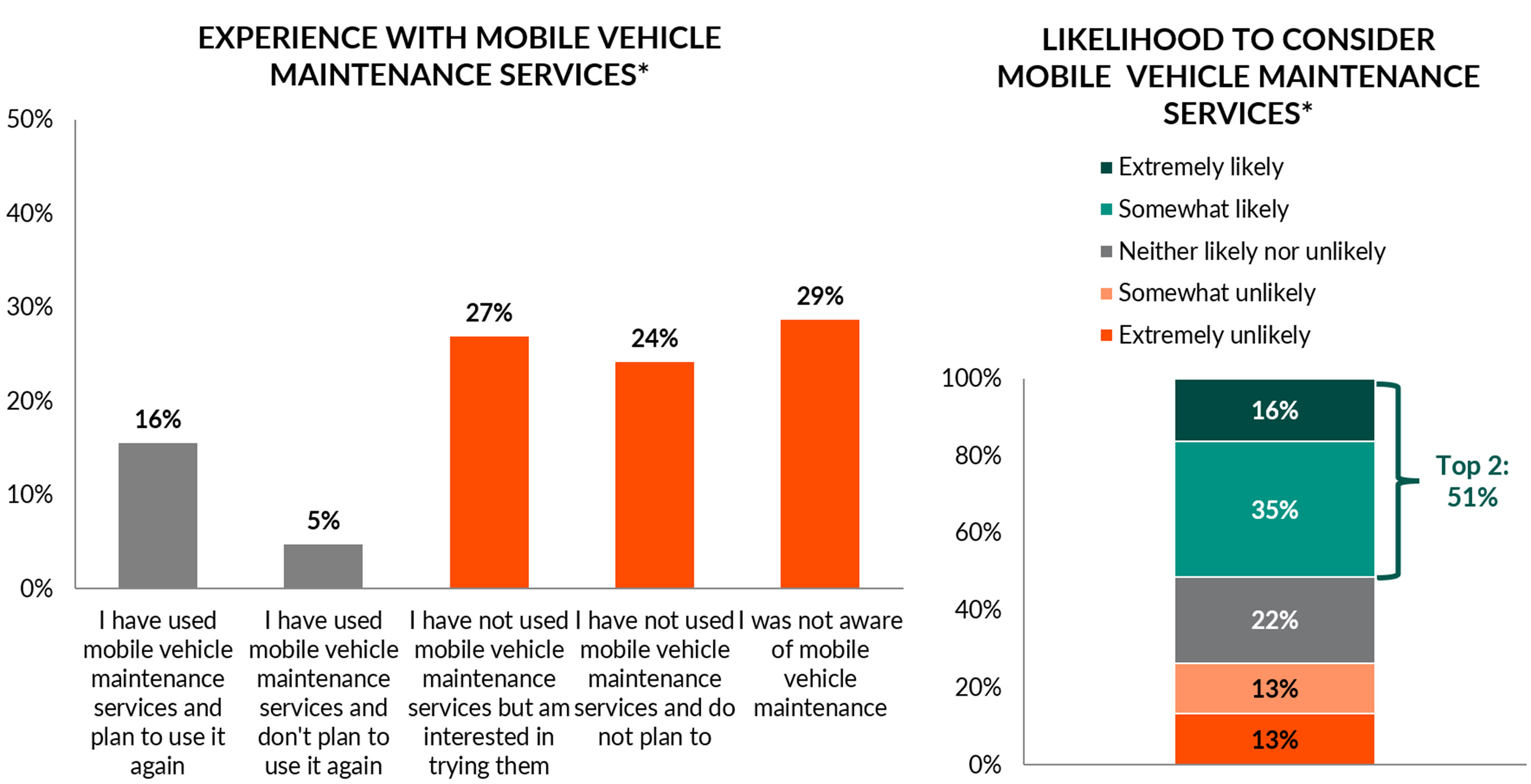

Another aspect of vehicle maintenance that is worth watching is mobile service – where the service provider performs maintenance at a vehicle owner’s residence. While most consumers have not used mobile vehicle maintenance services prior to this survey, half are likely to consider this in the survey (Figure 12).

Auto Care’s Government Affairs team is continuing to promote passage of federal right to repair legislation to ensure that independent repair shops have access to vehicle data to perform maintenance and repair work on owners’ vehicles. This ensures that consumers are free to choose their service provider and keeps a level playing field in the industry. Please take a moment to fill out this form to tell your local legislators of the importance of this issue! You may also scan the QR code and access additional resources through Auto Care’s Right to Repair media kit.

What Should Aftermarket Retailers and Service Providers Do?

At a high level, service providers and retailers should:- Vehicle owners prefer DIY vehicle maintenance primarily for cost savings and DIFM service for the expertise and professional experience. Service providers should emphasize these drivers when targeting customers.

- Given DIY consumers’ higher likelihood to be price-sensitive, they are more likely to opt for lower-cost tools and materials when performing maintenance rather than expensive performance grade materials. Tool, equipment, and parts manufacturers should balance this with quality considerations and message accordingly.

- With elevated prices across the industry (labor, materials, shipping), service providers and retailers should continually monitor consumer trends and preferences.

More Details and Forthcoming Research

Members can access the complete research report on the Digital Hub. We at Auto Care will keep you informed on new research as we publish it! A few things to watch for:- June: Joint Channel Forecast and Factbook

- November: Updates to our Joint E-Commerce and EV Adoption Outlook and Forecast Reports

Michael Chung, Director, Market Intelligence

Ready to dive into market research? I provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. More About Me

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Content

-

[WATCH] Driver Behavior Trends and Their Impact on Parts and Service Opportunities

March 17, 2022This webinar analyzes driving behavior at the national, state, and local levels. Gain insights into: consumer behavior; driving patterns; and potential impacts on parts replacement, service and repair scheduling, vehicle age, and the car parc.

-

[WATCH] 2022 Business Outlook: Top Emerging Opportunities and Challenges

February 4, 2022This webinar explores need-to-know emerging opportunities and challenges for the coming year: current status of supply chain issues and what to expect in the year ahead and more.

-

[WATCH] How to Use Vehicle Miles Traveled to Better Your Bottom Line in 2022

December 3, 2021Vehicle Miles Traveled has been respected for years as a key indicator of aftermarket opportunities. Historically, planning has been limited to directional indicators but now aftermarket businesses can leverage more detailed insights on geographic differences as well as vehicle differences to more effectively take advantage of aftermarket opportunities.