September 19, 2023

Aftermarket Response to High Inflation, High Interest Rates and Inventory Challenges

by Michael Chung

Context and Methodology

Auto Care’s Market Intelligence Committee wanted to know how companies were dealing with recent economic trends – with interest rates increasing, how were companies responding to higher capital costs? With inflation climbing past 9% earlier in the year, were they absorbing higher costs or passing them on to customers? Thinking about supply chain challenges over the past three-and-a-half years, what did companies do if they had stocked up on inventory but ended up being stuck with it – did they devalue it? Change their accounting methodology?So I surveyed our members – executives and managers familiar with their company's strategy, accounting/billing, real estate, supply chain and inventory management, and other aspects of their operations. I then interviewed five executives across the supply chain – a B2B parts distributor, two parts manufacturers, a repair and maintenance shop and an automotive products distributor to explore the survey questions in further depth.

Key takeaways

So what did I learn?- Strategic shifts in products, customers and markets have been fairly common, with corresponding changes in key indicator review and exploration of new categories, markets, suppliers and customers.

- Inventory management has become more critical – many companies have been more pro-active and agile in monitoring and adjusting inventory levels of finished products as well as input materials.

- While not used by all companies, supply chain technologies represent an opportunity for greater efficiency and cost savings across the aftermarket.

- Customers have evolved their purchase patterns, reinforcing the necessity of tighter inventory management and communication with suppliers and customers.

- Adapting to shifting market conditions and increasing operating efficiencies will continue to be necessary for success.

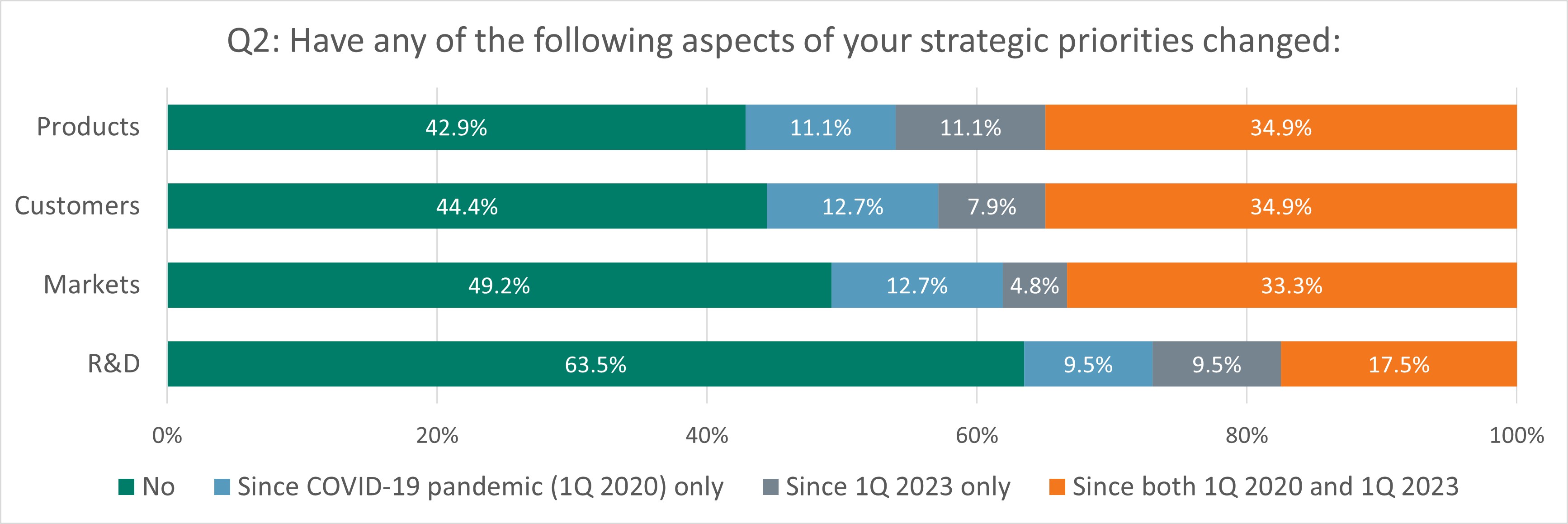

Strategic priorities are revisited more frequently

N=63. Survey conducted July 2023 by Auto Care Association.

With shifts in product availability, one company I spoke with was forced to find new suppliers overseas since its domestic suppliers couldn't meet demand. The executive emphasized the importance of pro-active communication with suppliers in both directions – knowing whether or not a shipment would arrive on time, whether it was complete or incomplete, and whether or not additional shipping costs would be charged was critical. Being able to set and manage expectations with his trading partners was critical, as well as knowing whether or not previously agreed-to contract terms would still hold.

Similarly, one parts manufacturer considered expanding into categories that it had previously only dabbled in – the pandemic provided an opportunity to observe the recreational vehicle industry and realize that participants in that sector were scattered. This led to exploration of supplying products to this previously untapped market.

The cadence of strategic discussion became more frequent for several companies I spoke with – a B2B parts distributor described it as “a balance between introducing new elements/programs, operationalizing them and evaluating performance”. As a result, business owners were engaged to gain insights on the effectiveness of tactics and their impact on key performance indicators.

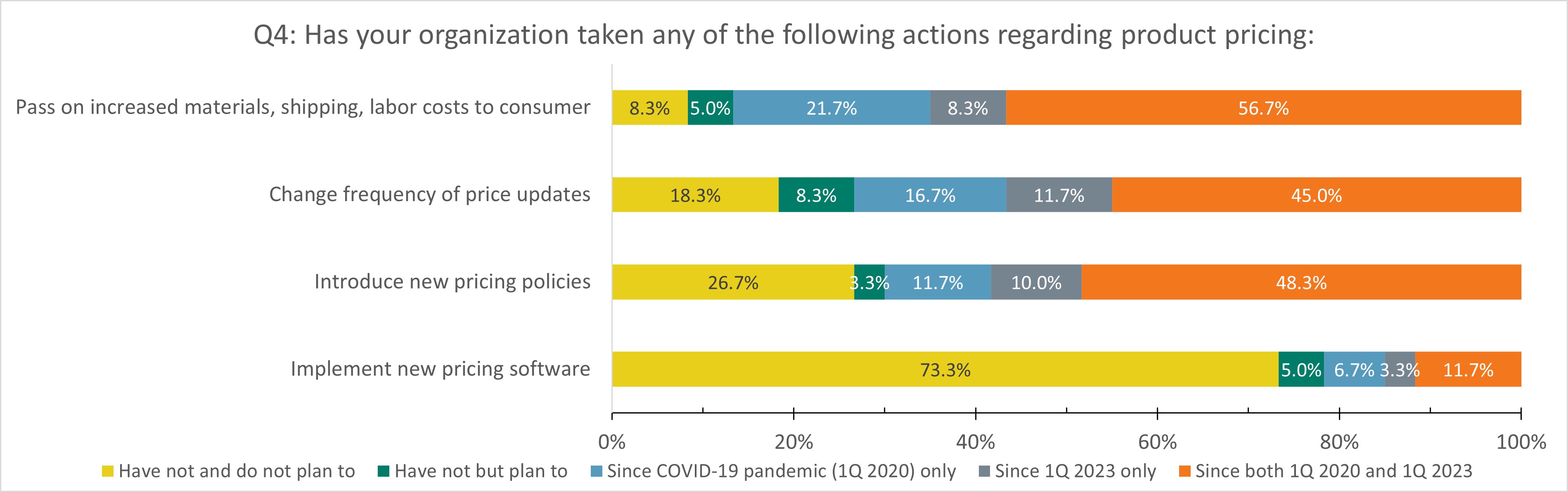

Higher costs – to absorb or not to absorb?

The survey demonstrated that higher materials, shipping and labor costs were generally passed on to customers: N=60. Survey conducted July 2023 by Auto Care Association.

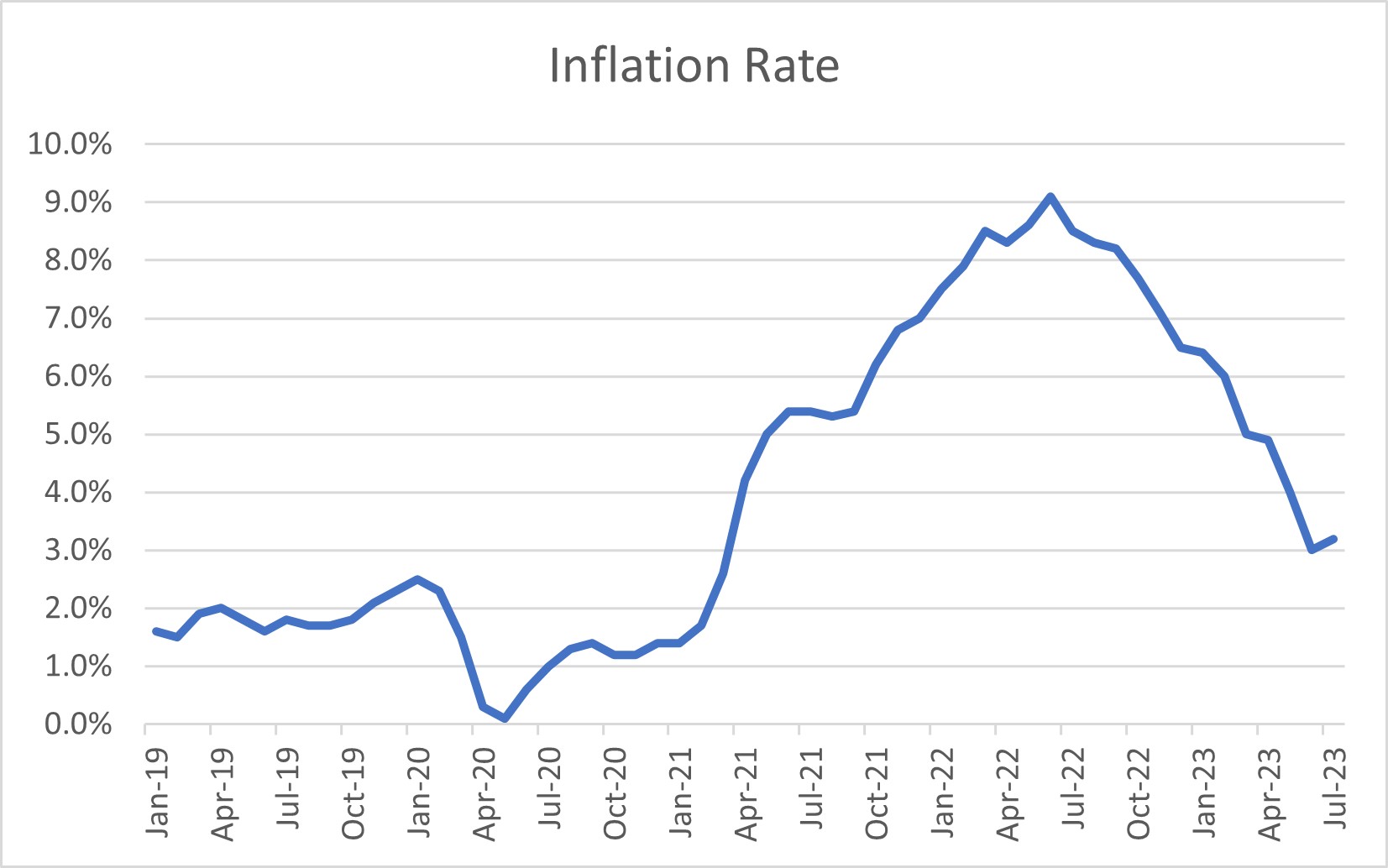

N=60. Survey conducted July 2023 by Auto Care Association.It’s no secret that inflation was high throughout the past year:

TrendLensTM. https://trendlens.autocare.org/reports/indicator-data

TrendLensTM. https://trendlens.autocare.org/reports/indicator-data As charted, price updates and pricing policies were also more frequent – one company I spoke with had three cost increases in a 14-month span (this had previously happened annually).

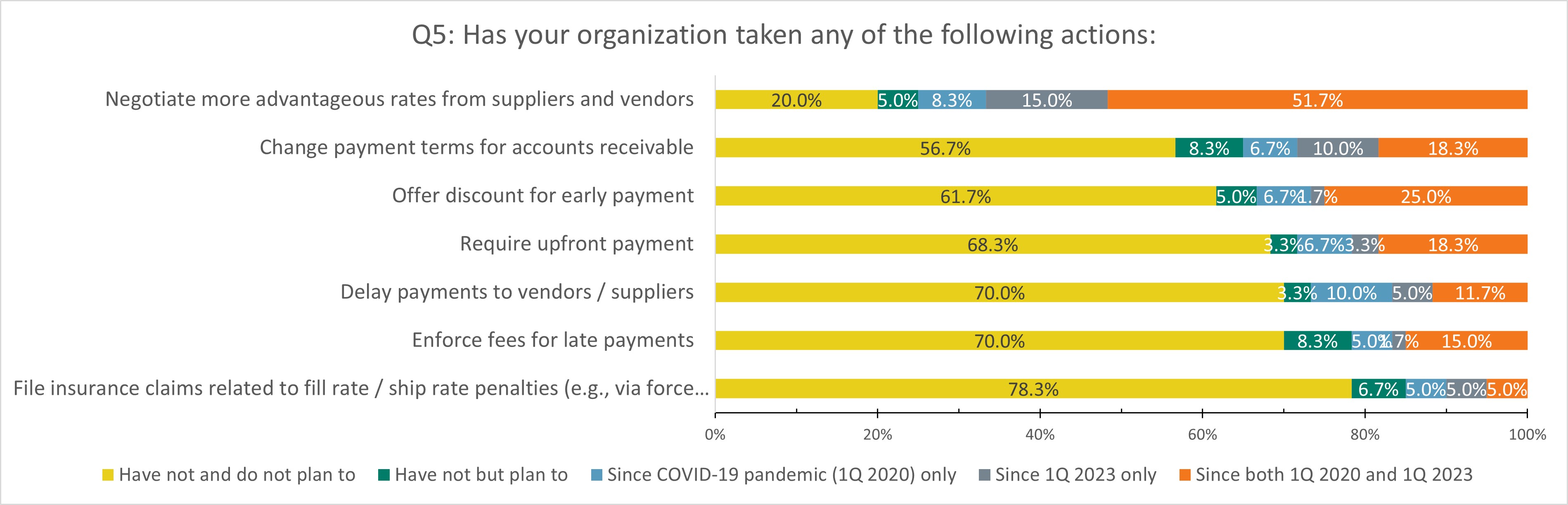

In response, it was common for companies to negotiate with suppliers and vendors:

N=60. Survey conducted July 2023 by Auto Care Association.

As illustrated, changes in payment terms and discounts for early payment were not uncommon, and even a handful of companies filed insurance claims related to supply chain snafus.

Depending on the company, other considerations needed to be weighed – for example, preferred vendors, strategic accounts and banner programs; whether only one provider was available. Higher prices are here to stay, though – as one executive put it, “Even if we have negative inflation rate for the next few years, pricing will never get lower”.

“I’ll arm-wrestle with the bank for a lower rate”

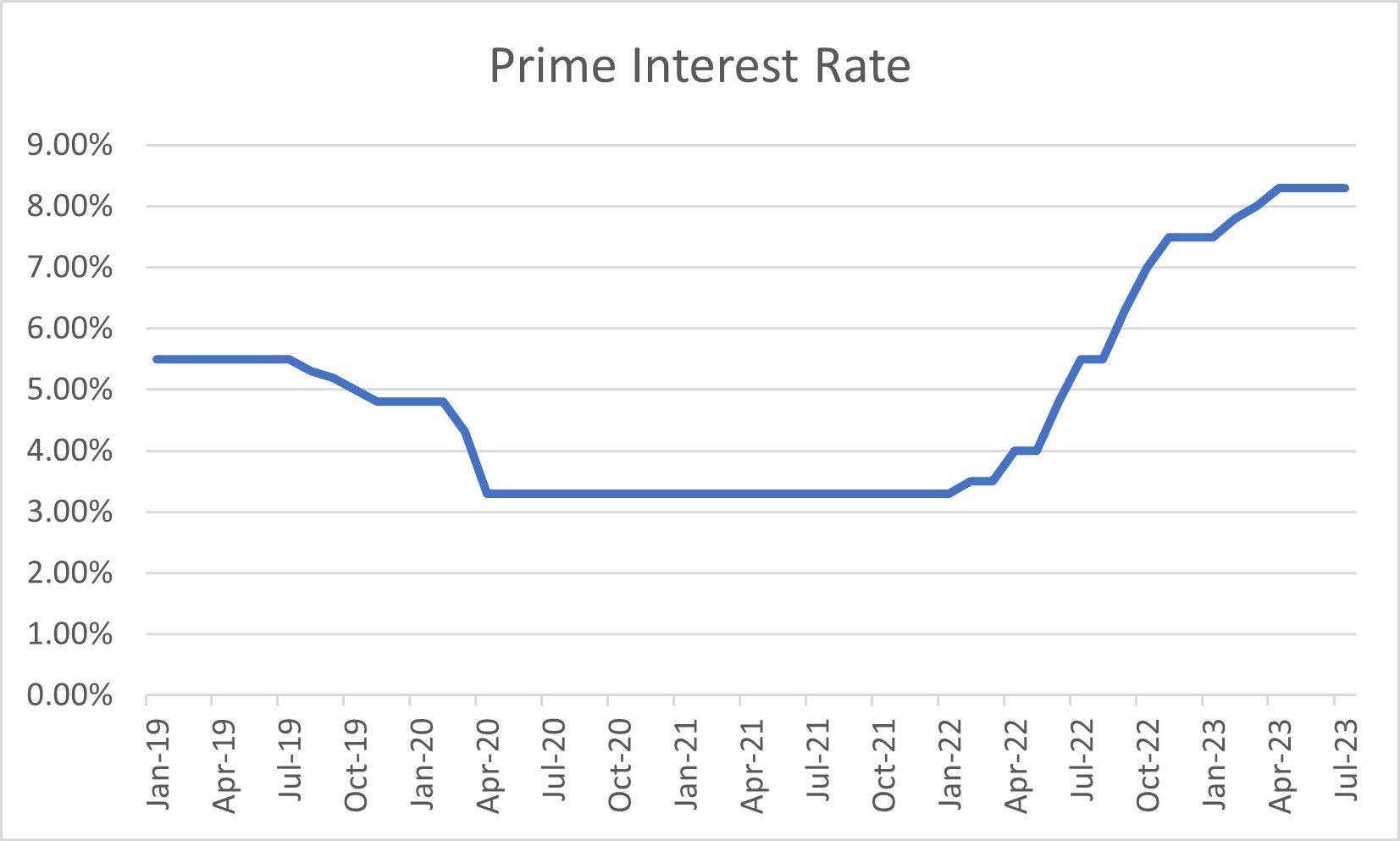

As pictured below, interest rates have risen throughout the year, pushing the cost of capital higher: TrendLensTM. https://trendlens.autocare.org/reports/indicator-data

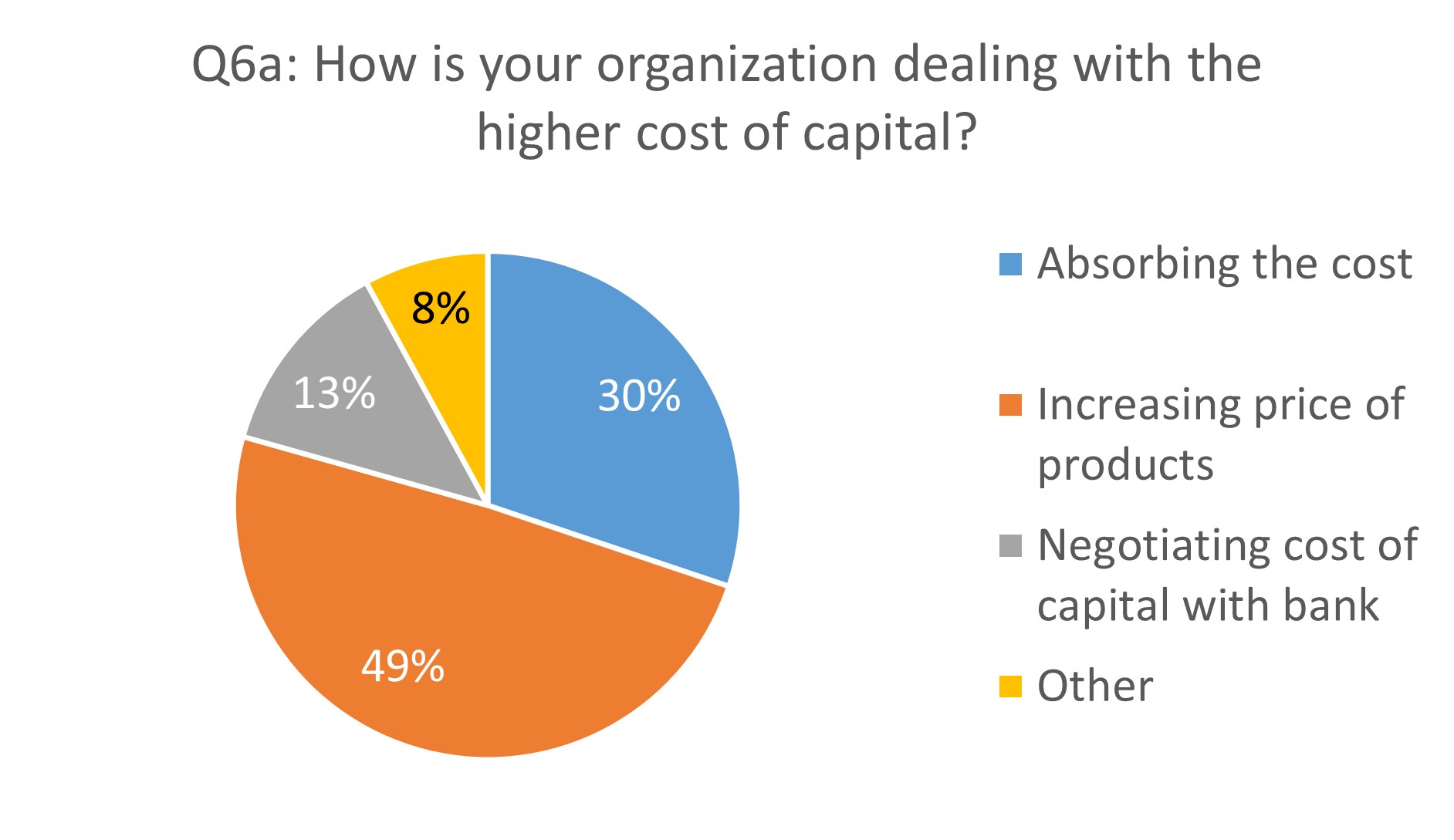

TrendLensTM. https://trendlens.autocare.org/reports/indicator-data Half of aftermarket companies are increasing product prices, 30% are absorbing the costs and 1 of 8 are negotiating with their banks. For some companies, this is not an issue as they are “debt-free with cash in the bank”.

N=63. Survey conducted July 2023 by Auto Care Association.

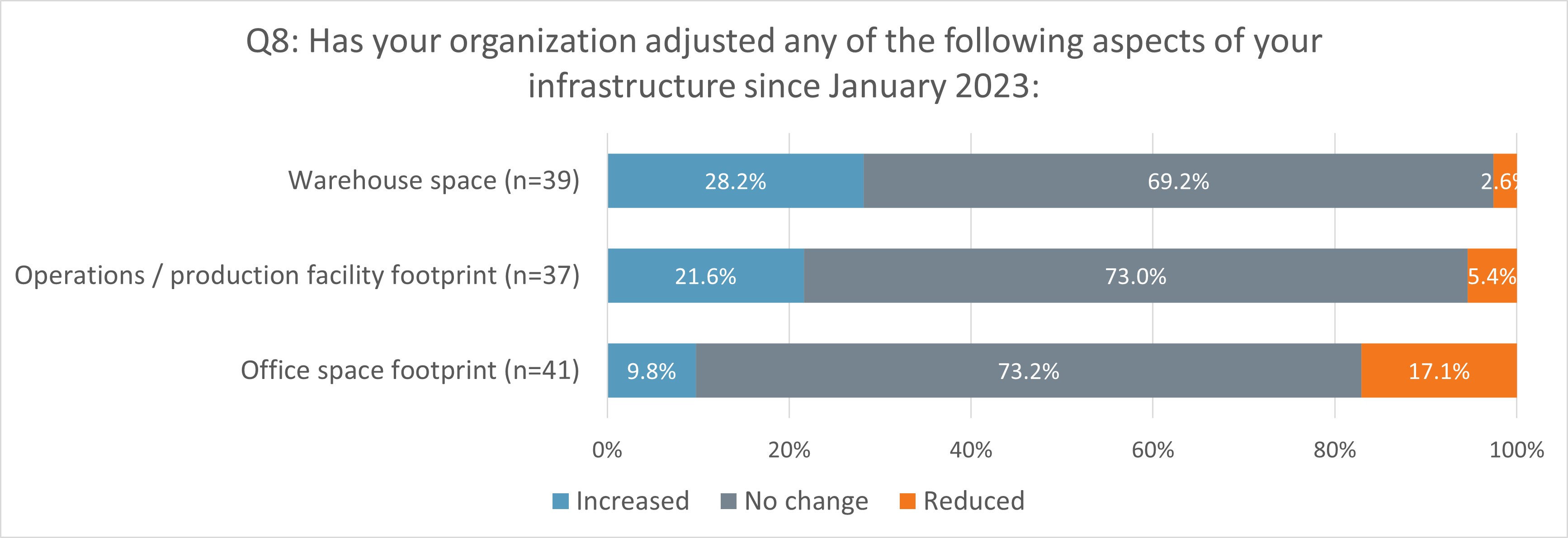

N=63. Survey conducted July 2023 by Auto Care Association.Some companies taking advantage of favorable commercial real estate environment

While most companies haven't changed their warehouse space, operations / production facility footprints, or office space footprints, one-quarter have increased their warehouse space, and one-fifth have increased their operations/production facility space:

Survey conducted July 2023 by Auto Care Association.

Survey conducted July 2023 by Auto Care Association.Supply chain management complements inventory management efforts

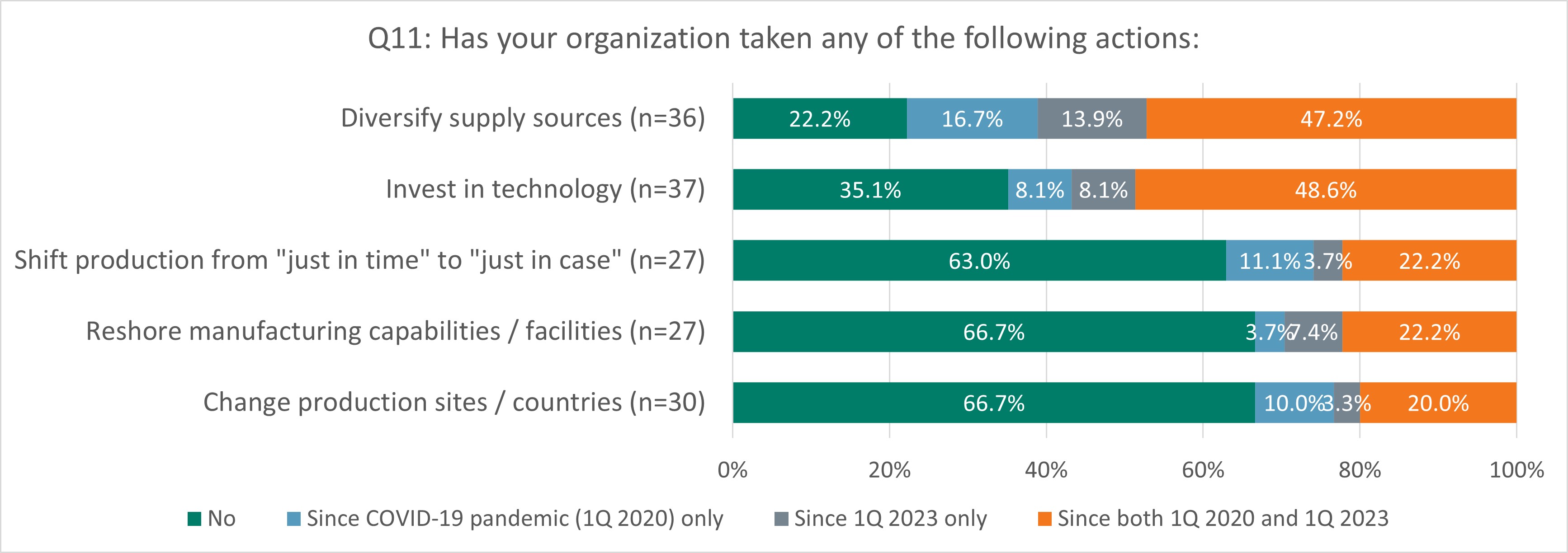

In addressing supply chain issues, aftermarket companies most frequently diversified supply sources and invested in technology. Change of production sites and reshoring of facilities were additional tactics, but for fewer companies.

Survey conducted July 2023 by Auto Care Association.

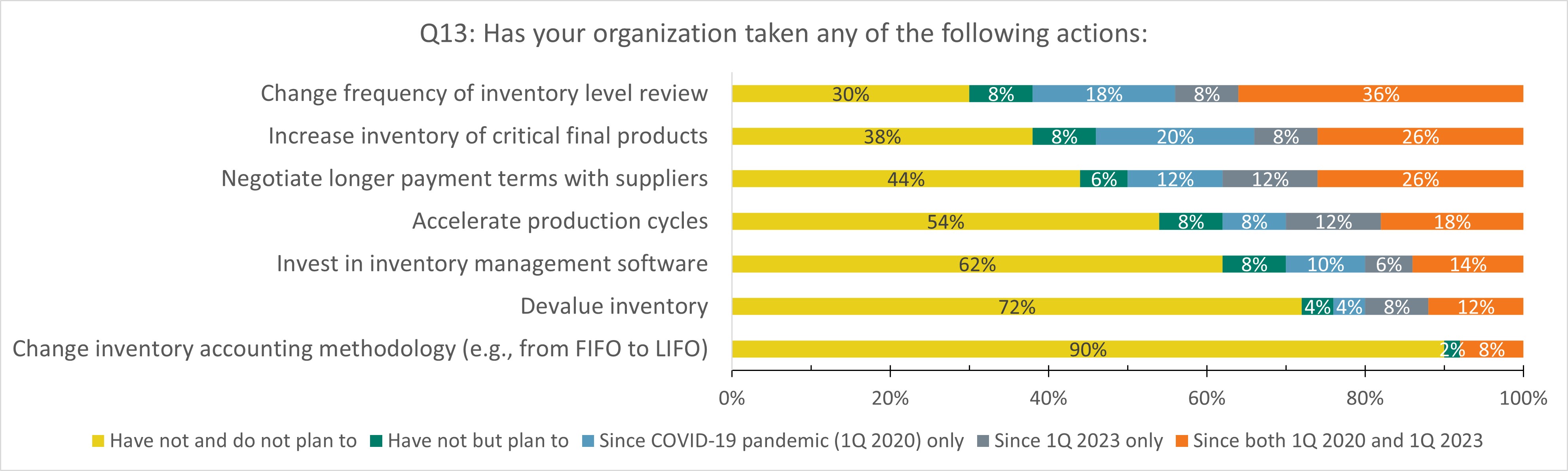

Similarly, increased inventory of critical input materials was common, as was reduction of product offerings. Inventory level reviews and increased inventory of critical final products most frequent. Very few companies have changed their inventory accounting methodology or devalued their inventory.

N=50. Survey conducted July 2023 by Auto Care Association.

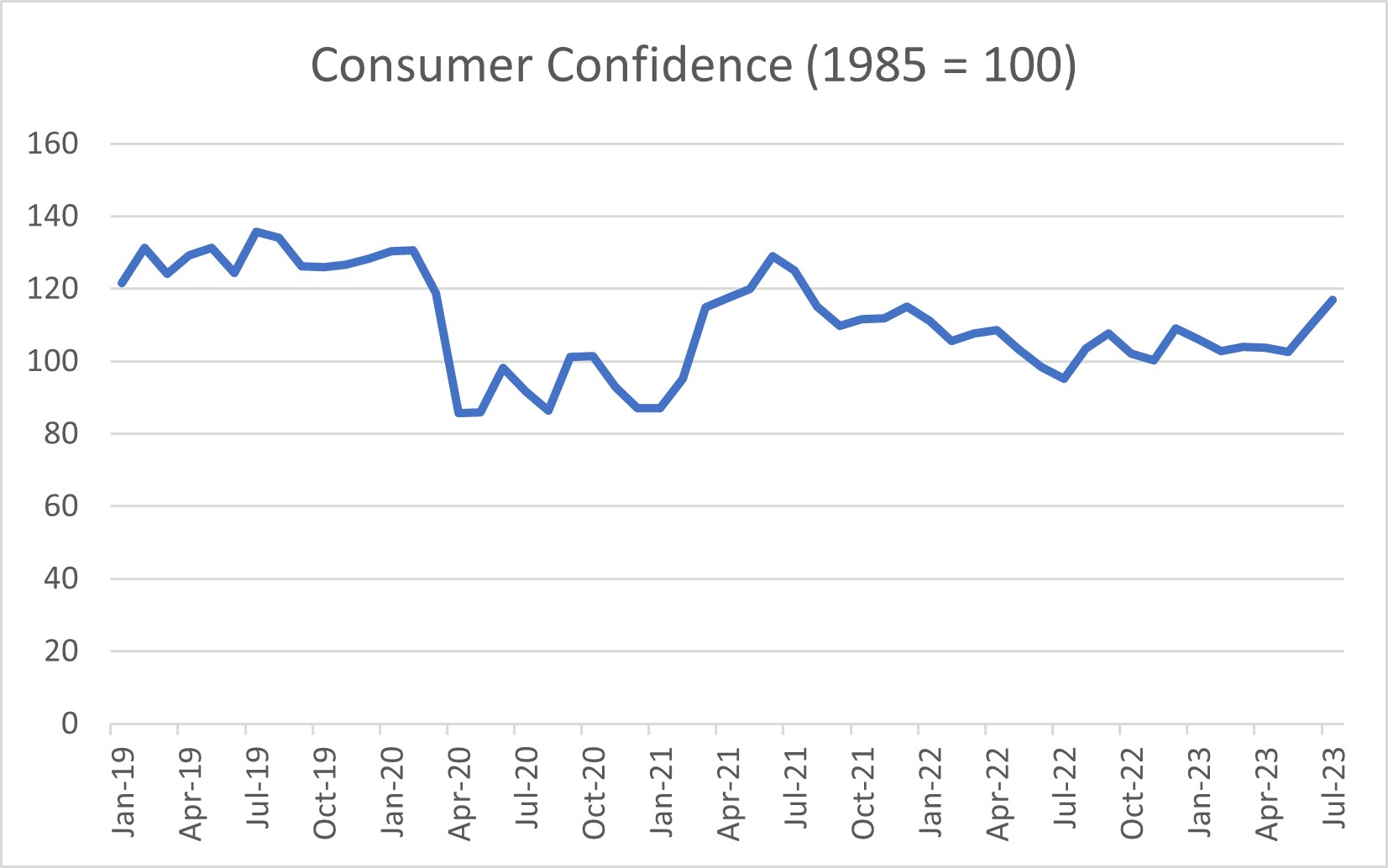

N=50. Survey conducted July 2023 by Auto Care Association.Customer behavior changes appear to reflect fluctuating consumer confidence

Since the pandemic, consumer confidence has reached historic lows, weighed down by recession and employment concerns, exacerbated by higher inflation despite higher disposable income: TrendLensTM. https://trendlens.autocare.org/reports/indicator-data

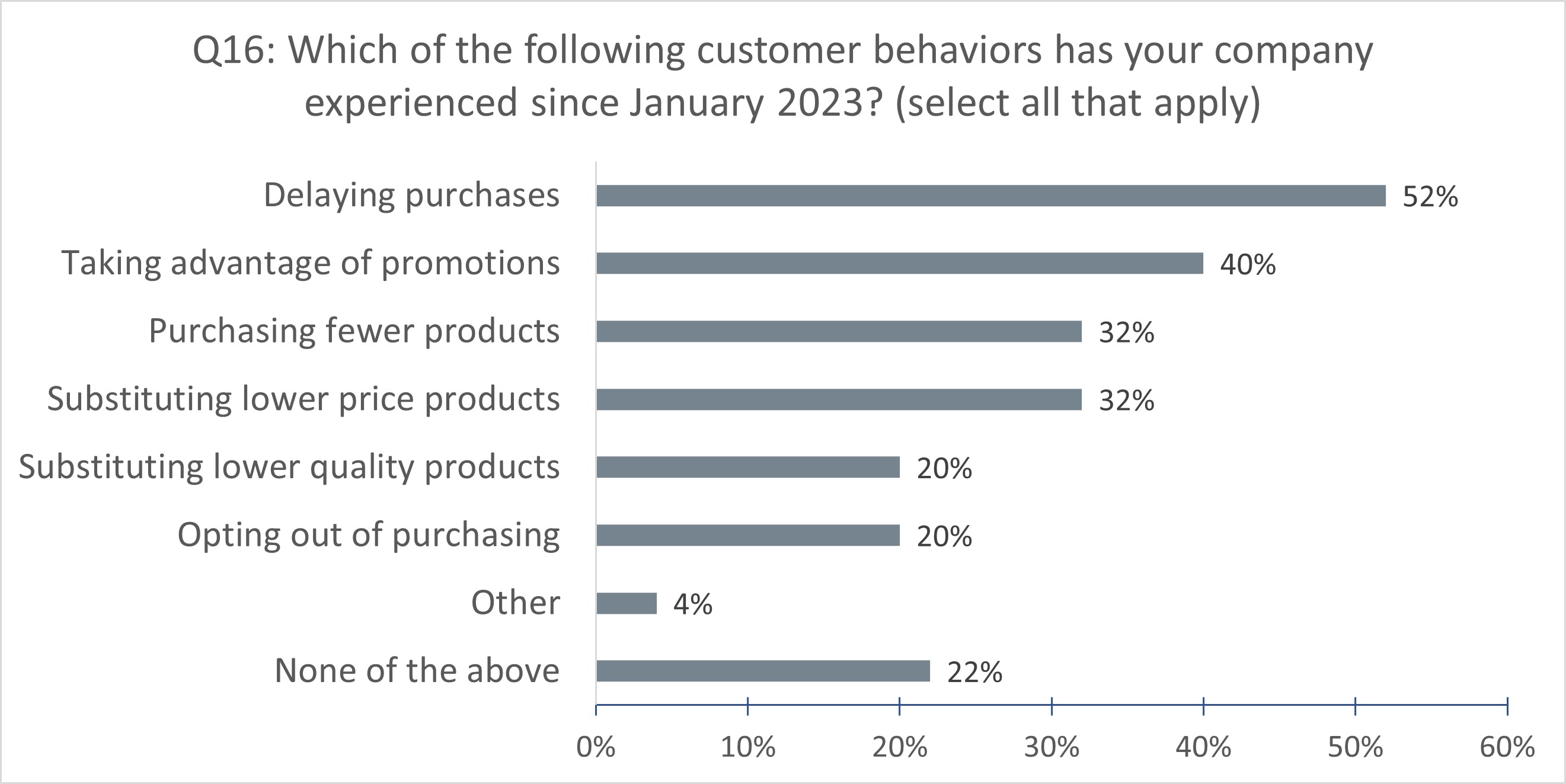

TrendLensTM. https://trendlens.autocare.org/reports/indicator-data As participating companies span the aftermarket, customers include consumer and business, arguably mirroring general consumer sentiment, with half of companies seeing customers delay purchases and many observing customers taking advantage of promotions, purchasing less, substituting lower price products and even lower quality products, if not opting out of purchasing altogether:

N=50. Survey conducted July 2023 by Auto Care Association.

And while consumers have been cost-conscious, it is noteworthy that nearly one-quarter of companies have not observed these kinds of consumer behavior changes.

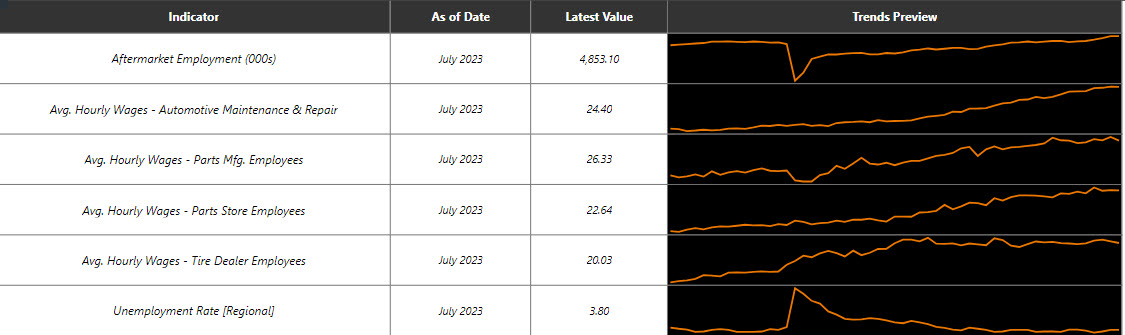

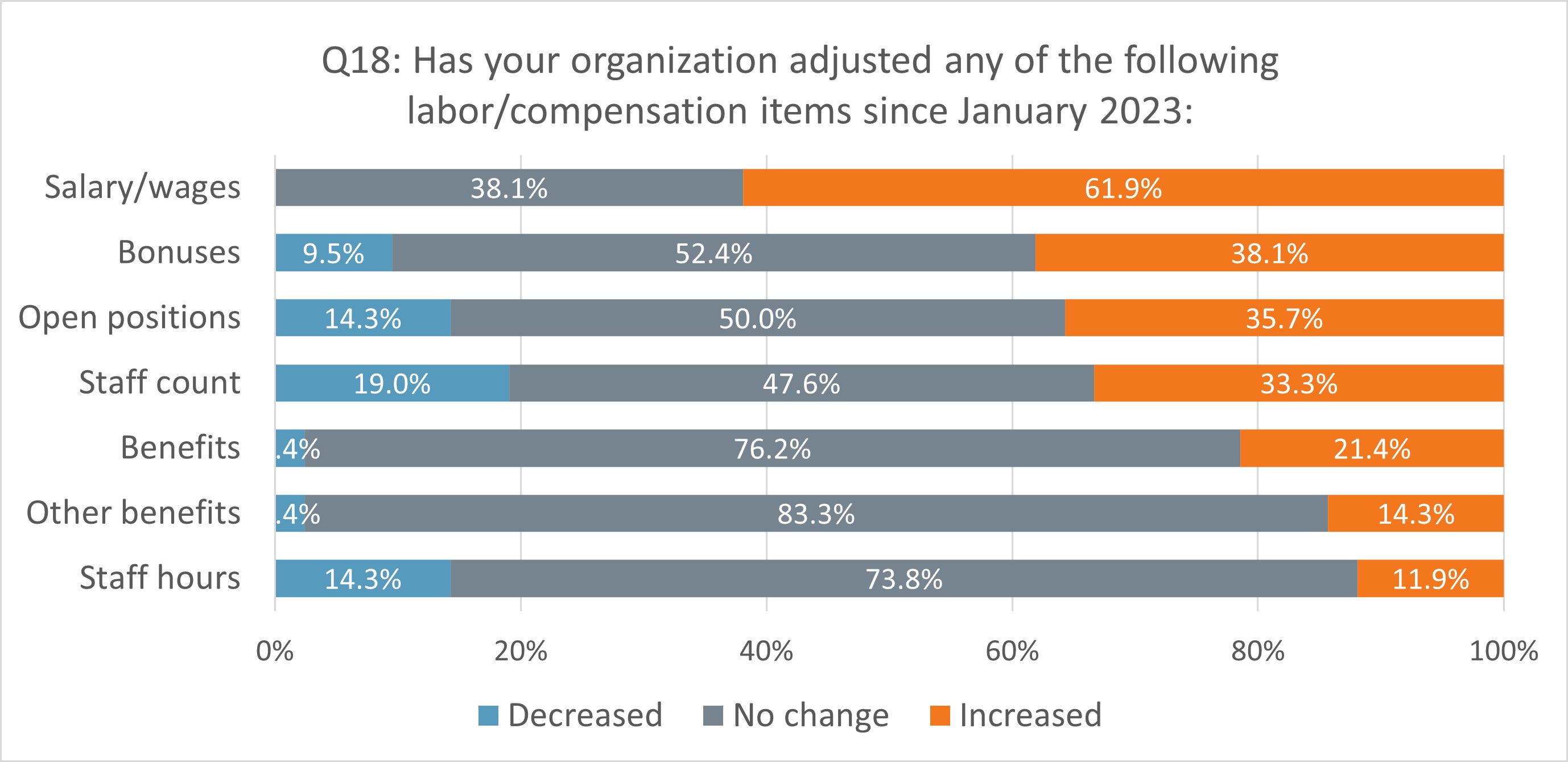

Companies invest more in employees

With unemployment being low, employment and wages across the aftermarket have risen: TrendLensTM. https://trendlens.autocare.org/reports/dashboard-data

TrendLensTM. https://trendlens.autocare.org/reports/dashboard-data Not surprisingly, companies across the industry are taking better care of workers – higher salaries/wages, along with increased bonuses and benefits are common:

N=42. Survey conducted July 2023 by Auto Care Association.

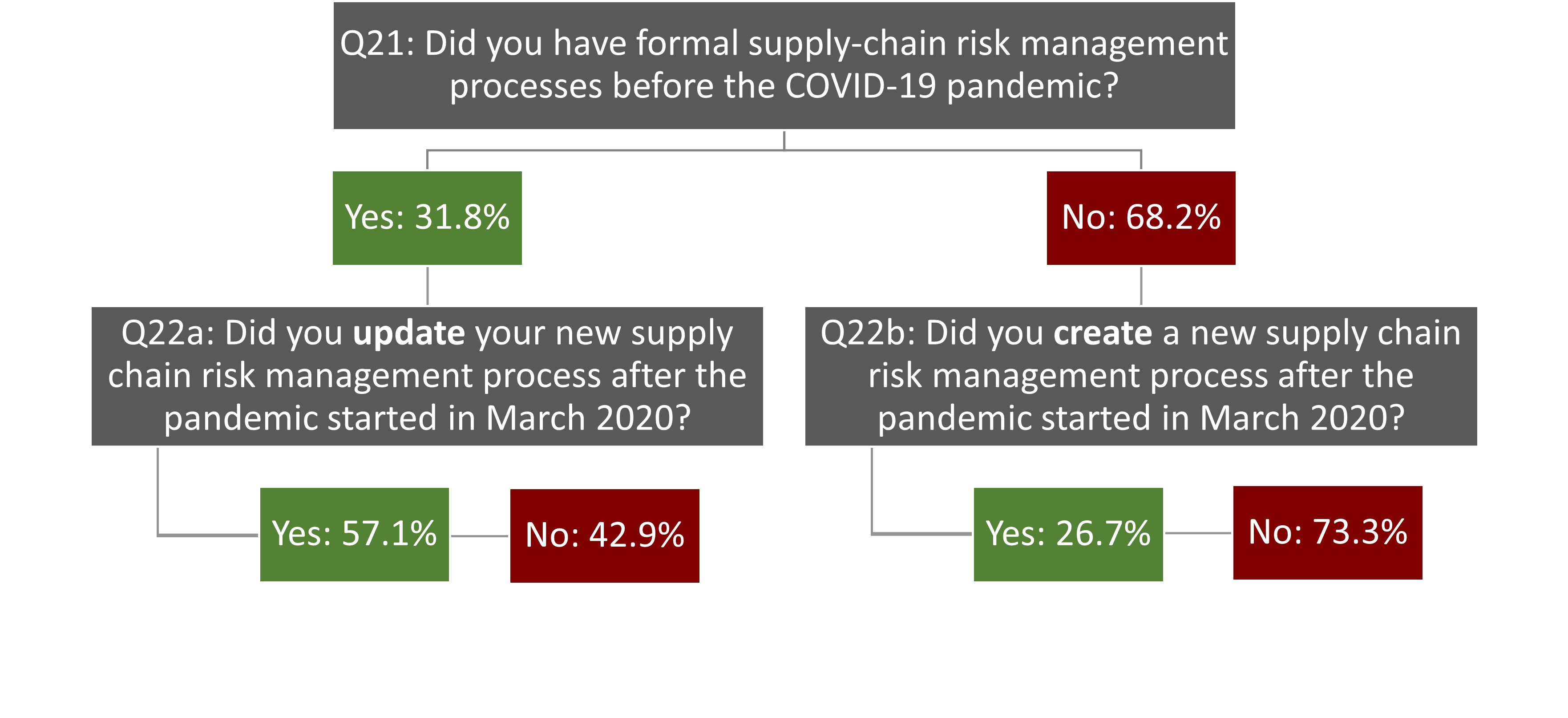

Supply chain risk management plans uncommon

Q21: N=44; Q22a: N=14; Q22b: N=30. Survey conducted July 2023 by Auto Care Association.

Learn more in a live discussion

"There's more?" Of course there's more! I’ll host a webinar to hear more about the study on Thursday October 5 at 1pm ET. Register Now

Michael Chung, Director, Market Intelligence

Ready to dive into market research? I provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. More About Me

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Latest related

Content

-

[WATCH] Driver Behavior Trends and Their Impact on Parts and Service Opportunities

March 17, 2022This webinar analyzes driving behavior at the national, state, and local levels. Gain insights into: consumer behavior; driving patterns; and potential impacts on parts replacement, service and repair scheduling, vehicle age, and the car parc.

-

[WATCH] 2022 Business Outlook: Top Emerging Opportunities and Challenges

February 4, 2022This webinar explores need-to-know emerging opportunities and challenges for the coming year: current status of supply chain issues and what to expect in the year ahead and more.

-

[WATCH] How to Use Vehicle Miles Traveled to Better Your Bottom Line in 2022

December 3, 2021Vehicle Miles Traveled has been respected for years as a key indicator of aftermarket opportunities. Historically, planning has been limited to directional indicators but now aftermarket businesses can leverage more detailed insights on geographic differences as well as vehicle differences to more effectively take advantage of aftermarket opportunities.

Visit